Last updated September 6, 2023

Does Your State Have a Law That Requires PTO Payout?

Many states require employers to pay out the value of your unused vacation time, sick leave, or other paid time off (PTO) when you quit, retire, or are terminated. This is different from prohibiting “use-it-or-lose-it” policies which require employees to forfeit unused PTO by a particular date.

Does your state require PTO payout at separation? Find out below.

Yes

Depends

No

What is PTO payout?

PTO payout is when a company pays the value of an employee’s unused vacation time, sick leave, or other paid time off (PTO). Payout of unused PTO usually happens at employment separation or at year’s end. To calculate a PTO payout, multiply an employee’s hourly pay rate (or equivalent) by the number of unused PTO hours they’ve accrued.

In some cases, companies are required to pay an employee for their unused vacation or sick time at separation, regardless of whether they quit, were laid off, or were fired. However, many states allow companies to implement PTO policies that say employees forfeit unused vacation or sick time if they’re fired, or if they don’t meet certain conditions (like giving 2 weeks notice). Typically, the employer has to put the conditions in writing (e.g. in their PTO policy or contract) and give the employee notice of the policy ahead of time.

When Does a Company Have to Pay Out PTO?

Typically, companies pay out unused PTO for two reasons:

- Because PTO payout is mandated by law

- Through a PTO payout program

Many states require companies to pay out an employee’s earned but unused PTO at employment separation (aka when they quit, retire, or are fired). Some states require payout of vacation time, some states require payout of paid sick leave, and some states require both.

A handful of states prohibit use-it-or-lose-it policies for vacation time, sick leave, or both. These states effectively require employers to pay out unused PTO at the end of the year, as well.

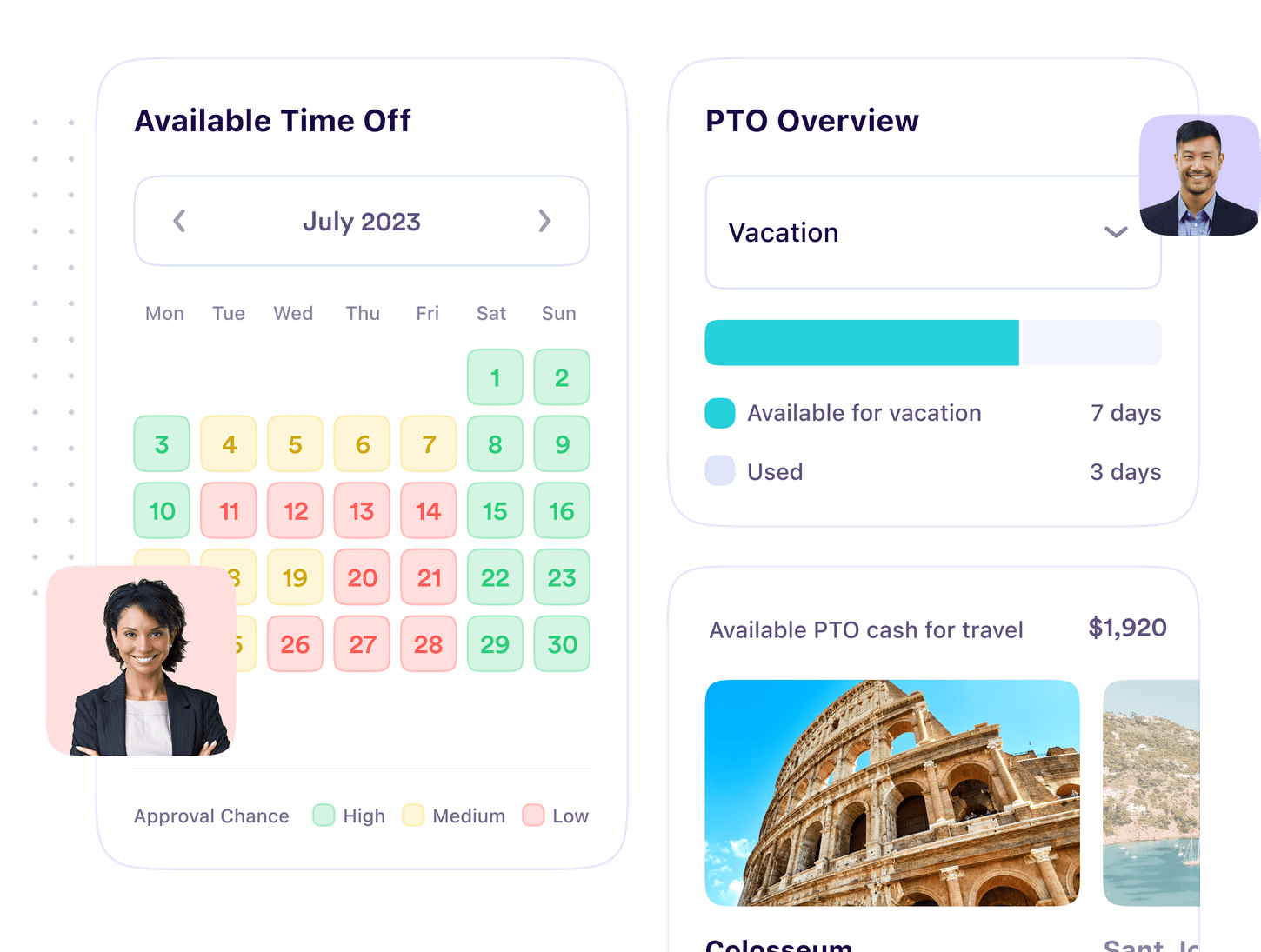

Many companies now offer year-round PTO payout through PTO conversion programs. Compared to basic vacation cash-out, PTO conversion offers employees more ways to use the value of unused vacation time or sick leave. Through PTO conversion, employees can contribute to their retirement savings, pay down their student loans, or get cash to cover financial emergencies or big purchases.

How Does PTO Payout Work?

To calculate PTO payout, take an employee’s hourly pay rate and multiply it by the number of PTO hours they’re expecting to cash out. For a salaried employee, convert their salary into its hourly equivalent and use that number. Finally, subtract 22% for taxes to get the final PTO payout number.

Remember: You may have different policies towards payout of vacation time versus payout of sick leave. Be sure to use the right number of PTO hours to calculate an employee's payout.

Note: Most states require you to use the employee's currently hourly rate to calculate payout. But in some states, it's their pay rate when they accrued the PTO. Still other states require you to use whichever is higher. When in doubt, contact your state's Department of Labor.

PTO Payout Example: Hourly Employee

For an hourly employee making $22 per hour with 80 hours of unused vacation time:

($22 per hour) x (80 hours unused PTO) = $1,760 value of unused PTO

($1,760 PTO value) x (.22 for taxes) = $387.20 deducted for taxes

$1,760 PTO value - $387.20 taxes = $1,372.80 final PTO payout

PTO Payout Example: Salary Employee

For a salary employee making $80,000 per year with 80 hours of unused vacation time:

($80,000 per year) / (2,080 working hours per year) = $38.46 equivalent hourly rate

($38.46 hourly rate) x (80 hours unused PTO) = $3,076.80 value of unused PTO

($3,076.80 PTO value) x (.22 for taxes) = $676.90 deducted for taxes

$3,076.80 PTO value - $676.90 taxes = $2,399.90 final PTO payout

PTO Payout vs. Use-It-Or-Lose-It

PTO payout is not the same thing as use-it-or-lose-it. PTO payout refers to what happens to unused paid time off when an employee leaves their company (quit, laid off, or fired). Use-it-or-lose-it is when employees automatically forfeit any vacation time or sick leave that they haven’t used by a particular date.

- 20 U.S. states require PTO payout at employment separation

- Three states prohibit use-it-or-lose-it policies for vacation time

- 15 states may prohibit use-it-or-lose-it for sick leave

Do Companies Have to Pay Out Sick Time?

Whether your company has to pay out unused sick time depends on the laws of the state you're in, and your company's policies. Most companies do not have to pay out unused paid sick leave when a person leaves the company.

- Colorado and Wyoming require payout of sick time

- In the District of Columbia, North Dakota, and Ohio, the wording of the law is not clear, but payout may be required

- In West Virginia, it depends entirely on the wording of your company policies

Which States Require PTO Payout?

There are 20 U.S. states that require companies to pay out the value of an employee’s unused earned paid time off (vacation time, sick leave, or both) at employment separation: California, Colorado, District of Columbia (Washington, D.C.), Illinois, Indiana, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Montana, Nebraska, New Mexico, New York, North Carolina, North Dakota, Ohio, Rhode Island, West Virginia, and Wyoming.

State | Vacation Payout Required? | Sick Leave Payout Required? |

|---|---|---|

California (vacation only) | Yes | No |

Colorado | Yes | Yes |

District of Columbia (Washington, D.C.) | Yes | Possibly |

Illinois | Yes | No |

Indiana | Yes | No |

Louisiana | Yes | No |

Maine | Yes | No |

Maryland | Yes | No |

Massachusetts | Yes | No |

Minnesota | Yes | No |

Montana | Yes | No |

Nebraska | Yes | No |

New Mexico | Yes | No |

New York | Yes | No |

North Carolina | Yes | No |

North Dakota | Yes | Possibly |

Ohio | Yes | Possibly |

Rhode Island | Yes | No |

West Virginia | Depends | Depends |

Wyoming | Yes | Yes |

Alabama

Alabama does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Alabama requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Alabama employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Alaska

Alaska does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Alaska requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Alaska employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Arizona

Arizona does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

Arizona labor law requires payment of due wages after employment separation but does not include accrued vacation time in its definition of wages. Further, Arizona’s paid sick leave law specifically says that payout of unused sick leave at separation is not required. Therefore, Arizona employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Arkansas

Arkansas does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Arkansas requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Arkansas employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

California

California requires PTO payout at separation for unused accrued vacation time.

California labor law considers paid vacation time to be a form of wages that is earned as labor is performed. According to California law, all earned wages are due at employment separation, regardless of the reason for separation. Therefore, employers in California must always pay out an employee’s unused accrued vacation at separation.

Vacation payout in California is calculated based on an employee’s final rate of pay as of their date of separation and prorated based on how many days of the year the employee worked.

For example, an employee who earned $22 per hour and was entitled to 120 hours of vacation per year, and who quit their job on the 300th day of the year after taking no vacation, would be due $2,164.80 vacation pay at separation based on the following calculation:

Quit at 300 days ÷ 365 days per year = 82% of the year

82% of 120 hours of vacation = 98.4 hours of vacation earned

(98.4 hours of vacation) x ($22 per hour) = $2,164.80 vacation pay due at separation

California does not require PTO payout at separation for paid sick leave unless promised by an employer’s contract or policy, with important clarifications.

Employers in California do not have to pay out unused sick leave when an employee leaves the company or is terminated. However, if an employee’s PTO policy or employment contract provides for payout of unused sick leave, the employer must abide by those terms.

Additionally, it’s important to note that, outside the context of employment separation, unused sick leave must carry over from year to year unless an employer front-loads their employee’s full amount of sick leave at the beginning of the year.

Colorado

Colorado requires PTO payout at separation for accrued vacation time, even under unlimited PTO policies, with important clarifications.

Colorado labor law considers vacation pay to be a form of wages protected by the Colorado Wage Act. According to Colorado law, unused vacation pay must be paid out at employment separation regardless of whether an employee resigns, is fired, or leaves for any other reason.

The Colorado Department of Labor and Employment (CDLE) defines “vacation pay” as any form of paid leave that may be used for any purpose at the employee’s discretion. Even leave that is called something else, such as “personal days,” “paid time off (PTO)”, “annual leave,” or “floating holidays”, can meet this definition of vacation pay.

In addition, the Colorado supreme court has ruled that all vacation pay that is earned and determinable must be paid out at the end of the employment relationship, and any terms that involve the forfeiture of earned vacation pay are void.

Even an unlimited PTO policy may be required to pay out unused vacation time. According to the CDLE, an employer that claims to offer unlimited PTO but doesn’t actually allow its employees to take more than a certain amount of vacation time is actually providing a specific, determinable amount of PTO that can be calculated for purposes of vacation payout.

Colorado vacation payout is calculated based on the employee’s pay rate immediately before they told their employer they were quitting, or before the employer decided to terminate them. However, employers may implement PTO policies or employment contracts which state that vacation is paid at the rate an employee was being paid when they earned the vacation time.

Colorado does not require PTO payout at separation for unused paid sick leave unless promised by an employer’s contract or policy.

Employers in Colorado do not have to pay out unused sick leave when an employee leaves the company or is terminated. However, if an employee’s PTO policy or employment contract provides for payout of unused sick leave, the employer must abide by those terms.

Additionally, Colorado's Healthy Families & Workplaces Act (HFWA) states that employees must be allowed to carry over up to 48 hours of unused sick leave from one year to the next. If an employer has its own PTO policy, it must meet these carryover minimum requirements. That said, according to the CDLE there is no requirement that unused sick leave be paid out at separation in the same way as unused vacation or general PTO.

Connecticut

Connecticut does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Connecticut requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Connecticut employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Delaware

Delaware does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Delaware requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Delaware employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

District of Columbia

The District of Columbia (Washington, D.C.) requires PTO payout at separation for vacation time, except under certain conditions.

Washington, D.C. courts have ruled that “leave time” is considered a form of wages that is earned as services (labor) are performed, and that employees have the right to this compensation. Therefore, D.C. employers must pay out the value of any unused accrued vacation when an employee leaves their company, regardless of the reason for separation. However, the courts have also ruled that an employer may lawfully implement a policy or contract that does not allow for payout of unused vacation time, so long as the employee has agreed to it.

To be safe, employers in the District of Columbia should include any forfeiture terms in their written vacation policy or employment contract, and should require written acknowledgement from employees.

The District of Columbia (Washington, D.C.) does not require PTO payout at separation for paid sick leave, unless promised by an employer’s policies.

The District of Colubmia’s paid sick leave law requires that unused sick leave carry over from year to year. However, employers are not required to pay employees for unused paid sick leave upon termination or resignation. That said, the position of the state Department of Labor (DoL) is that if a company has a policy that is more generous than the minimum established by the law, the DoL will enforce that company’s policy. “More generous” in this context can include a statement that they will pay out unused sick leave upon employment separation.

Florida

Florida does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Florida requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Florida employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Georgia

Georgia does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Georgia requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Georgia employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Hawaii

Hawaii does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Hawaii requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Hawaii employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Idaho

Idaho does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Idaho requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Idaho employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Illinois

Illinois requires PTO payout at separation for vacation time in all cases, even if an employer’s contract or policy includes forfeiture.

Illinois law states that whenever an employment contract or policy provides for paid vacation time, any unused earned vacation time must be paid out when an employee separates from their employment, whether they resign or are terminated. Although Illinois allows use-it-or-lose-it by a particular date, the state’s Department of Labor does not recognize any employer contract, policy, or practice that includes forfeiture of earned vacation time at separation.

Illinois does not require PTO payout at separation for unused paid sick leave, unless promised by an employer’s contract.

Unlike vacation time, Illinois does not require employers to pay out the value of unused earned paid sick leave when an employee leaves the company. According to the Illinois Department of Labor, employees are not entitled to sick pay upon separation unless their employment contract or other agreement (e.g. PTO policy) promises it.

Indiana

Indiana requires PTO payout at separation for vacation time except under certain conditions.

Indiana considers vacation pay to be a form of compensation that is protected by the Indiana Wage Payment Statute. Under the law, employees are entitled to be paid the value of accrued-but-unused vacation time at employment separation. However, employers are allowed to implement PTO policies or employment contracts that include certain conditions which must be met before accrued vacation pay will be paid out. For example, an employer may require employees to give two weeks’ notice in order for their unused vacation time to be paid out.

To be safe, employers should include any vacation forfeiture terms in their written vacation policy or employment contract, and should require written acknowledgement from their employees.

Indiana probably does not require PTO payout at separation for unused paid sick leave, although the law isn’t fully clear.

No statute or case law in Indiana specifically refers to sick leave payout. Therefore, Indiana employers are probably not required to pay out unused sick leave at separation unless their employment contract or sick leave policy promises it, although the law isn’t fully clear. To be safe, an employer should include any sick leave payout or forfeiture terms in their written policy or contract, and should require written acknowledgement from employees.

Iowa

Iowa does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Iowa requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Iowa employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Kansas

Kansas does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Kansas requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Kansas employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Kentucky

Kentucky does not require PTO payout at separation for vacation and probably does not require it for sick leave, unless promised by an employer’s contract or policy.

Kentucky law states that vested vacation pay “and any other similar advantages” is a form of wages, and that all wages must be paid out at employment separation. However, the Kentucky Supreme Court has ruled that, “No Kentucky statute requires an employer to compensate an employee for accumulated vacation time.” In their same ruling, the court also wrote, “Nor is there an inherent right either to a vacation or to payment for unused vacation time,” and “Vacation pay is purely a matter of contract between employer and employee.”

Although Kentucky labor law and the Kentucky Supreme Court’s judgment seem to be at odds, the court ruling holds precedence. Therefore, employers in Kentucky are not required to pay out the value of an employee’s unused accrued vacation time at employment separation. An employee is only entitled to payout of unused vacation if their employer’s policy or contract promises it.

Neither the law nor the courts have specifically ruled on payout of unused paid sick leave, but the same judgment is likely to apply.

Louisiana

Louisiana requires PTO payout at separation for vacation time, but it’s not fully clear whether employers can require forfeiture of earned vacation pay under certain conditions.

Unused earned vacation time must be paid out at employment separation in Louisiana. Louisiana law considers paid vacation time to be a form of wages if an employee has accrued it and has not taken or been compensated for it at the time they quit or are fired. Louisiana requires all due wages to be paid out at employment separation, regardless of the reason for separation. However, Louisiana courts are split on whether employers can implement policies under which employees forfeit earned vacation pay if they do not meet certain conditions, such as giving two weeks’ notice.

For example, the Louisiana Supreme Court ruled against an employer policy which stated that accrued paid time off benefits were forfeited when the employee "abandons his position" (quits without proper notice), finding that this policy was in violation of Louisiana wage law. On the other hand, the Louisiana Fifth Circuit Court of Appeals previously found no issue with an employer’s policy that treated accrued vacation pay as a benefit, not an earned wage, and which stated that it would not pay out earned vacation to employees terminated for cause.

Most recently, a Louisiana intermediate appeals court held that accrued vacation paid days off constitute earned wages which must be paid at employment separation under the law. The court also wrote that a promised benefit becomes a vested right when an employee’s actions meet the conditions for earning the benefit.

Therefore, it is most likely that Louisiana employers must pay out unused earned vacation time at employment separation, regardless of the reason for separation.

Any employer that wants to implement a policy or contract under which employees forfeit accrued vacation pay, or that already has such a policy, should consider consulting an employment lawyer to determine whether their policy is compliant.

Louisiana may require PTO payout at separation for unused paid sick leave, although the law isn’t fully clear.

Louisiana’s Wage Payment Act defines wages as “including the cash value of all remuneration paid in any medium other than cash”, but neither the act nor Louisiana courts have specifically said whether this applies to sick leave. However, the Louisiana intermediate appeals court’s finding that a promised benefit becomes a vested right when an employee’s actions meet the conditions for earning the benefit is relevant. Additionally, the court wrote that, “The accrual of the right to be compensated while not at work, whether labeled “vacation,” "paid days off,” or any other similar label” is what triggers the Wage Payment Act’s final wage requirements to become applicable.

Given that paid sick leave which accrues with time worked can easily be interpreted as falling under “any other similar label”, it’s most likely that Louisiana does in fact require payout of unused paid sick leave at employment separation.

Any employer that wants to implement a policy or contract under which employees forfeit accrued paid sick leave, or that already has such a policy, should consider consulting an employment lawyer to determine whether their policy is compliant.

Maine

Maine requires PTO payout at separation for vacation time, except under certain circumstances.

As of January 1, 2023, a revision to Maine’s labor laws requires all employers in Maine with 11 or more employees to pay out unused vacation time at employment separation. The revised law applies to paid vacation accrued under an employer’s policy on and after this date. Employers with 10 or fewer employees are exempted.

Maine does not require PTO payout at separation for unused paid sick leave.

The revised law also applies to PTO policies that lump together vacation time, sick leave, and other PTO, but it does not apply to standalone sick leave policies. Employers in Maine are not required to pay out unused paid sick leave unless it has been accrued under a general PTO policy that includes vacation time.

Maryland

Maryland requires PTO payout at separation for vacation time except under certain conditions.

Maryland labor law defines wages as including fringe benefits such as vacation leave. According to Maryland statute, employees are entitled to payment for all wages owed at separation, including unused vacation pay. However, the statute outlines specific conditions under which employers are not required to pay out unused vacation time.

In essence, vacation payout at separation is not required if all three of the following conditions are met:

- The employer has a written policy to that effect

- The employer notified the employee of their leave benefits at time of hiring

- The terms of the policy mean that the employee isn’t entitled to payment for accrued leave at termination

Maryland does not require PTO payout at separation for unused paid sick leave, unless an employer’s written contract or policy promises it.

Maryland labor law includes sick leave in its definition of wages, but employers are not required to pay out unused earned paid sick leave when an employee quits or is terminated. The Maryland Department of Labor considers sick leave to be “a contingency against illness” which cannot be claimed at separation in the same way as vacation time. However, if an employer’s employment contract or sick leave policy provides for payout of sick leave, the employer must abide by those terms.

Massachusetts

Massachusetts requires PTO payout at separation for vacation time.

According to the Massachusetts Attorney General, employers must pay their employees for accrued or earned paid vacation leave upon separation from employment, regardless of the reason for separation. Employers in Massachusetts may not enforce policies wherein employees forfeit any part of their accrued vacation when they leave a company, whether they quit voluntarily or are terminated.

Massachusetts does not require PTO payout at separation for unused sick leave, unless an employer’s written contract or policy promises it.

Unlike vacation time, accrued sick leave is not considered a form of wages under the Massachusetts Wage Act. Therefore, Massachusetts employers are not required to pay out the value of unused paid sick leave when an employee leaves the company. However, if an employer’s contract or policy provides for payout of paid sick leave, they must abide by those terms.

Michigan

Michigan does not require PTO payout at separation for vacation time or sick leave unless an employer’s written contract or policy promises it.

Michigan considers vacation time and sick leave to be “fringe benefits” that are controlled by the company according to their written contract or policy. Michigan employers must pay out unused earned fringe benefits like vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Minnesota

Minnesota requires PTO payout at separation for vacation time and sick leave, except under certain conditions.

Minnesota statute requires that an employee be paid all wages they are due at separation of employment. Minnesota courts have found that “paid time off or vacation pay” are considered a form of wages. This is backed up by the Minnesota Department of Revenue which includes vacation pay and accumulated sick leave in a list of “taxable wages”. Therefore, accrued vacation time and sick leave must be paid out at separation.

However, Minnesota employers may implement a policy or contract that includes provisions under which an employee is not paid out their accrued PTO, such as if an employee fails to give two weeks notice. To be safe, an employer should include any forfeiture terms in their written policy or contract, and require written acknowledgement from employees.

Mississippi

Mississippi does not require PTO payout at separation for vacation time or sick leave.

No law in Mississippi requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Mississippi employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Missouri

Missouri does not require PTO payout at separation for vacation time or sick leave.

No law in Missouri requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Missouri employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Montana

Montana probably requires PTO payout at separation for vacation time but most likely does not require it for sick leave, although the law is not fully clear.

Montana law is not exactly clear on whether or not PTO has to be paid out at separation. The Montana Department of Labor and Industry (DOLI) refers to an Attorney General opinion which says that once vacation time has been earned according to an employer’s policy, it is considered a form of wages and must be paid out at separation like regular wages. However, the DOLI also says that payout of “severance pay, sick leave or paid time off (PTO)... is dependent on an employer’s policy.”

For an employer that includes both vacation and sick leave under their definition of paid time off (PTO), neither the law nor the courts have said whether both leave types would have to be paid out at separation. Nor is it clear whether a PTO policy which lumps both vacation and sick leave together would have to be paid out.

The safest interpretation is that vacation time must be paid out at separation, but paid sick leave does not. Employers that lump both leave types together may want to consider separating them out in their written policy or contract.

To be safe, employers should include any forfeiture terms in their written PTO policy or employment contract, and should require written acknowledgement from employees.

Nebraska

Nebraska requires PTO payout at separation for vacation time but does not require it for paid sick leave.

Nebraska considers vacation time and sick leave to be “fringe benefits”. Under Nebraska law, fringe benefits are considered a type of wage. According to the Nebraska Department of Labor, employers must pay out all wages upon employment separation, including unused earned vacation and PTO benefits, with no exception.

However, Nebraska courts have ruled that unused sick leave is not a part of the wages payable to a separating employee, unless an agreement between an employee and employer states otherwise. Additionally, employers may implement a policy or contract that provides a sick leave benefit which has no monetary value at separation.

Nevada

Nevada does not require PTO payout at separation for vacation time or paid sick leave, except under certain conditions.

Nevada’s mandatory paid leave law requires most employers with 50 or more employees to provide roughly 1 hour of leave for every 52 hours worked. Leave accrued under the law carries over up to 40 hours from one year to the next, but employers are not required to pay out unused accrued paid leave at employment separation.

An employer may institute their own paid time off (PTO) policy that includes paid vacation or sick leave (or both), so long as it meets the minimum requirements established by the law. Nevada does not require an employer to pay out unused paid leave accrued under the employer’s own policy, unless the policy promises it.

New Hampshire

New Hampshire does not require PTO payout at separation for vacation or sick leave, so long as an employer’s policy or contract is clear on the matter.

New Hampshire law states that paid time off (PTO), when granted by an employer’s policy or contract, is considered wages “when due” according to the contingencies specified in the policy or contract. Therefore, employers may enact PTO policies that do not pay out accrued-but-unused PTO at separation, so long as employees sign an acknowledgement of their receipt of the policy. The same rules apply to payout of unused paid sick leave.

New Jersey

New Jersey does not require PTO payout at separation for vacation time or sick leave.

No law in New Jersey requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. New Jersey employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

New Mexico

New Mexico requires PTO payout at separation for unused vacation time.

New Mexico’s Administrative Code says that vacation pay “and other forms of pay for time that is not worked” are considered wages if they are earned as compensation for labor or services (i.e., if they accrue). The New Mexico Wage Payment Act says that unpaid wages or compensation must be paid out to an employee at employment separation. Therefore, employers in Mexico must pay out unused vacation time when an employee leaves the company, regardless of the reason for separation.

New Mexico probably does not require PTO payout at separation for paid sick leave, although it’s not fully clear.

New Mexico’s Healthy Workplaces Act (HWA) requires employers to grant at least 1 hour of paid sick leave for every 30 hours worked. The New Mexico Administrative Code includes “other forms of pay for time that is not worked” in its definition of wages. This would seem to include paid sick leave, provided that the sick leave accrues with time worked. However, the HWA states that employers are not required to pay out unused sick leave at employment separation.

Additionally, the HWA includes allowances for employers that use a single paid time off (PTO) policy that incorporates the requirements of the HWA. But the law does not clarify whether the payout exemption for HWA sick leave also applies to sick leave that accrues under an employer’s own paid sick leave policy.

Most likely, the wording of the HWA takes precedence and therefore employers do not have to pay out unused paid sick leave when an employee resigns or is terminated. That said, a sick leave policy that does not refer to itself as existing to comply with the state’s Healthy Workplaces Act could be subject to contestation. An employer with such a policy may wish to consult an employment lawyer to clarify whether they are obligated to pay out unused paid sick leave at separation.

New York

New York requires PTO payout at separation for unused vacation time, unless an employer’s policy includes forfeiture terms.

New York employers have to pay out an employee's unused vacation time at employment separation. However, employers are allowed to implement PTO policies under which employees lose accrued vacation under certain conditions, such as end of employment. For a forfeiture policy be valid, an employer must have informed its employees in writing of the conditions that nullify the benefit.

If an employee has earned vacation time and there are no forfeiture terms in their PTO policy or contract, the employer is required to pay out the unused vacation at separation.

New York does not require PTO payout at separation for unused paid sick leave.

New York’s mandatory paid sick leave law requires employers to grant at least 1 hour of sick leave for every 30 hours worked. Unused sick leave carries over to the next year, but employers are not required to pay out unused sick leave at employment separation. Employers with their own paid sick leave policies are not required to pay out unused earned sick leave at separation.

North Carolina

North Carolina requires PTO payout for vacation time, potentially even if an employer’s written policy provides for forfeiture.

The North Carolina Wage and Hour ACt (NCWHA) states that, once earned, vacation pay cannot be forfeited unless an employer has a forfeiture clause in its written vacation policy or termination policy. Even if an employer does have a written forfeiture clause, the North Carolina Department of Labor clarifies that an employee might still be owed their earned vacation pay at employment separation, depending on the language of the forfeiture clause and the reasons for their separation.

North Carolina does not require PTO payout at separation for unused paid sick leave unless promised by an employer’s policy or contract.

According to the North Carolina Department of Labor, unused paid sick leave does not have to be paid out at separation, even if there is no forfeiture clause in an employer’s policy or contract. Unused sick leave has to be paid out only if the policy or contract promises it, or if the employer follows this practice.

North Dakota

North Dakota requires PTO payout at separation for vacation time except under certain conditions.

Used earned vacation must always be paid out at separation in North Dakota, except under very specific conditions. North Dakota considers earned paid vacation to be a form of wages that must be paid out with an employee’s final paycheck. According to North Dakota law, “No employment contract or policy may provide for forfeiture of earned paid time off upon separation.”

If an employee quits voluntarily, an employer may withhold payment of accrued vacation if three conditions are met: the employee was employed for less than one year; the employee gave less than five days notice (written or verbal); and the employer gave prior written notice of this limitation.

Otherwise, if an employee separates from their employment, PTO payout may not be required if their vacation was granted but not yet “earned”, such as if it was front-loaded, and the employer provided prior written notice of this limitation.

North Dakota may require PTO payout for unused paid sick leave, although the law isn’t fully clear.

According to North Dakota law, “paid time off” is defined as including “annual leave, earned time, personal days, or any other provisions of the employment relationship intended to provide compensation as vacation.” According to the law, arrangements or policies under which time off accrues and can be used for any purpose are considered paid time off, unless an employer has a separate sick leave policy.

Given this definition of “paid time off”, it’s not fully clear whether an employer that provides paid sick leave would be required to pay out unused sick leave at employment separation. However, references to “vacation” in North Dakota law and Department of Labor guidance materials could be interpreted as meaning that the state’s PTO payout requirements only apply to earned paid vacation time, and not to earned paid sick leave.

To be safe, North Dakota employers that offer paid sick leave but do not wish to pay out unused earned sick leave at employment separation should include any forfeiture terms in a written policy or contract and require written acknowledgement from employees.

Ohio

Ohio requires PTO payout at separation for vacation time unless an employer clearly communicates its forfeiture policy to its employees.

According to Ohio courts, employees are entitled to be paid for their earned vacation days because this is considered a deferred payment of a benefit which the employee has earned. However, employers may implement a PTO policy which does not allow for payout of unused earned vacation, if the employer clearly communicates the policy to its employees. A policy that is silent on the matter must pay out unused vacation at separation.

Ohio may require PTO payout at separation for unused paid sick leave, although the law isn’t fully clear.

Neither Ohio law, Department of Labor, nor the courts have not given explicit guidance on whether the state’s rules regarding payout of unused vacation time also apply to paid sick leave. However, given the Ohio court’s emphasis on the earning of vacation based on length of service and time worked, it’s likely that this could also be applied to paid sick leave that accrues (is earned) with time worked.

Oklahoma

Oklahoma does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Oklahoma requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Oklahoma employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Oregon

Oregon does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Oregon requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Oregon employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Pennsylvania

Pennsylvania does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Pennsylvania requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Pennsylvania employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Rhode Island

Rhode Island requires PTO payout at separation for vacation time under certain conditions, but does not require it for unused paid sick leave.

Rhode Island requires employers to pay out the value of an employee’s unused earned vacation time upon employment separation, provided that the employee has worked for them for at least one year. After a year of employment, vacation pay (including prorated vacation) is considered wages and is due within 24 hours of the time of separation.

Earned paid sick leave, however, does not have to be paid out at separation.

South Carolina

South Carolina does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

South Carolina law defines “wages” as including vacation, holiday, and sick leave that has accrued and is due under an employer’s policy or employment contract. However, the South Carolina Department of Labor has clarified that payout of unused earned vacation and/or sick time at employment separation depends on company policy. Therefore, employers in South Carolina must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

South Dakota

South Dakota does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

South Dakota’s Division of Labor and Management has written that paid leave is a matter of employer policy. No law in South Dakota requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Therefore, South Dakota employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Tennessee

Tennessee does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

Tennessee considers paid time off (PTO), vacation and sick pay to be “fringe benefits” that are determined by an employer. Unless an employer’s policy or contract specifically allows for payout of earned “vacation or compensatory time”, Tennessee employers are not required to pay out these benefits at employment separation. Therefore, South Dakota employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Texas

Texas does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Texas requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Texas employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Utah

Utah does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Utah requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Utah employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Vermont

Vermont does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Vermont requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Vermont employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Virginia

Virginia does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

No law in Virginia requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated. Virginia employers must pay out unused vacation time, sick leave, or other paid time off only if their PTO policy or employment contract promises it.

Washington

Washington does not require PTO payout at separation for vacation time or sick leave unless promised by an employer’s contract or policy.

Washington considers vacation time to be a “voluntary benefit” that does not have to be paid out with final wages. An employer may choose to pay out unused earned vacation with an employee’s final paycheck, but is not required to do so. However, a Washington employer must pay out unused vacation time, sick leave, or other paid time off if their PTO policy or employment contract promises it.

Washington employers are required by state law to provide paid sick leave to their employees according to the state’s Paid Sick Leave Law minimum requirements, but payout at separation is not mandated by the law. An employer may choose to pay out an employee’s unused earned sick leave at separation, but this is not required.

West Virginia

West Virginia may require PTO payout at separation for vacation time or sick leave, depending on the wording of an employer’s policy or contract

Whether an employer in West Virginia has to pay out unused vacation, sick leave, or other PTO at employment separation depends on the wording of their written policy. In all cases, an employer must pay out unused vacation time, sick leave, or other paid time off if its policy or contract promises it.

West Virginia considers vacation time, sick leave, PTO and several other forms of leave to be “fringe benefits”. In order for fringe benefits to be considered a form of wages, they must be capable of calculation and payable directly to an employee. The West Virginia Department of Labor clarifies that to meet these conditions, an employer’s written policy must include how fringe benefit accruals are calculated and the conditions for eligibility. If an employer’s policy is vague or ambiguous, the Department of Labor may rule in favor of the employee.

Additionally, West Virginia courts have found that an employer must pay out unused earned vacation or sick leave if its policy or contract is silent on the matter of payout.

Wisconsin

Wisconsin does not require PTO payout at separation for vacation time, unless an employer’s contract or policy promises it or is silent about it.

Wisconsin’s Department of Workforce Development defines “wages” as including vacation pay and sick pay when it comes to wage reporting for Unemployment Insurance. However, the Department also says that vacation time and sick leave are considered “fringe benefits” that are dictated by an employer’s policy. According to the Department, whether an employer has to pay out “unused benefit pay” depends on the terms of the employers’ vacation or resignation policy. If an employer has implemented a written policy and it does not include written forfeiture terms, then the employer must pay out any unused earned vacation pay at separation.

Wisconsin probably does not require PTO payout at separation for sick leave, although it’s not fully clear.

Although the Department does not specify whether the same conditions apply to paid sick leave, the inclusion of sick leave in its definition of “fringe benefits” most likely means that the same rules apply and that, therefore, unused paid sick leave does not have to be paid out at separation unless its policy promises it or is silent about it.

Wyoming

Wyoming requires PTO payout for vacation time and sick leave unless an employer’s written and acknowledged policy provides for forfeiture.

Wyoming defines “wages” as including “fringe benefits”. Employers in Wyoming are required to pay out fringe benefits, including unused earned vacation and sick leave, at employment separation. However, employers are allowed to establish policies under which earned vacation or sick leave is forfeited at the end of employment. Employers are also allowed to establish certain conditions that must be met for vacation or sick leave to be paid out.

In all cases, in order for such a policy to be lawful, it must state the terms clearly and in writing, and employees must have acknowledged it in writing.

Get notified as soon as laws change

Very Positive: My employer really cares about supporting new parents by giving me time

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Please contact your attorney to learn more about your local time off laws.

Experience the Future of Time Off, Today

See how PTO Genius saves you time and money while preventing burnout and compliance issues. Try our next-generation time off tracking, automation, and compliance platform for free today.

Sign Up For Free