Human Resources

PTO Accrual: The Costs of Calculating PTO

Key Takeaways

- PTO calculation is a tedious process that’s very prone to errors

- It requires 4 data entries and costs $19.19 to calculate and update an employee’s PTO balances

- Every error takes 22 minutes to fix, adding $18.94 in costs

- In total, it takes 25 to 47 minutes and costs $23.37 to $46.43 to calculate and update the PTO balances for a single employee

PTO calculation is a tedious process that’s very prone to errors. An Ernst & Young study, Estimating Labor and Non-Labor Costs Associated with Common Human Resources (HR) Functions/Tasks, found that it takes 4 data entries and costs $19.19 to calculate and update an employee’s PTO balances. The study also found a 16% average error rate, and that every error takes 22 minutes to fix, adding $18.94 in costs.

Adjusted for inflation, it takes 25 to 47 minutes and costs $23.37 to $46.43 to calculate and update the PTO balances for a single employee. This article dives deeper into those costs, and breaks them down by number of employees.

Thankfully, you can save this time and money by using time off management software to automatically calculate and update employee PTO balances.

How Long It Takes to Calculate PTO

Most paid time off (PTO) policies state that PTO accrues (is earned) as an employee works. To calculate PTO, you have to account for accrual rates, periods, starting balances, waiting periods, and more. If employees earn PTO based on the number of hours they actually work, you also need to verify the hours that an employee worked during each accrual period.

According to Ernst & Young, this requires four data entries and takes 25 minutes, on average. This assumes that things like accrual rate and period are already determined, and that you don’t have to check whether the employee is in their waiting period. Otherwise, it’ll take longer to calculate and update an employee’s PTO.

PTO Calculation: Time Required to Update Manually

Number of Employees | Data Entries | Total Time |

|---|---|---|

1 | 4 | 0.5 hours |

50 | 200 | 21 hours |

100 | 400 | 42 hours |

200 | 800 | 83 hours |

500 | 2,000 | 208 hours |

1,000 | 4,000 | 417 hours |

5,000 | 20,000 | 2,083 hours |

10,000 | 40,000 | 4,167 hours |

15,000 | 60,000 | 6,250 hours |

The Costs of Calculating PTO Accruals

EY calculated the labor costs of calculating PTO balances based on the average hourly rate of a person performing this task in 2018, which was $24 per hour. According to the U.S. Bureau of Labor Statistics inflation calculator, this is equivalent to $29.22 today.

In the initial study, EY found that it cost $18.94 in labor costs and $0.25 in non-labor costs to calculate and update PTO Balances. The total cost at the time, therefore, was $19.19. Adjusted for inflation, this is $23.06 in labor costs and $0.30 in non-labor costs, totalling $23.37 today.

The costs in the table below have been adjusted for inflation based on this data.

PTO Calculation: Cost to Update Manually

Number of Employees | Labor Costs | Non-Labor Costs | Total Costs |

|---|---|---|---|

1 | $23.06 | $0.30 | $23.37 |

50 | $1,153 | $15 | $1,168 |

100 | $2,306 | $30 | $2,336 |

200 | $4,612 | $60 | $4,672 |

500 | $11,530 | $150 | $11,680 |

1,000 | $23,060 | $300 | $23,360 |

5,000 | $115,300 | $1,500 | $116,800 |

10,000 | $230,600 | $3,000 | $233,600 |

15,000 | $345,900 | $4,500 | $350,400 |

How to Calculate PTO Accruals

PTO accrual is time-consuming and error-prone. This guide explains everything you need to know.

PTO Calculation Error Rates and Costs

PTO calculations are painful and costly enough on their own. But Ernst & Young’s research also found an average 16% error rate, costing an additional 22 minutes and $18.94 to fix ($23.06 adjusted for inflation).

At a company of 500 employees, this means 80 errors that take 29 hours of work to fix, costing nearly $2,000 on top of the opportunity costs of other important initiatives that you could be working on instead of fixing errors.

Number of Employees | Number of Errors | Time to Fix Errors | Error Costs |

|---|---|---|---|

1 | - | - | - |

50 | 8 | 3 hours | $184 |

100 | 16 | 6 hours | $369 |

200 | 32 | 12 hours | $738 |

500 | 80 | 29 hours | $1,845 |

1,000 | 160 | 59 hours | $3,690 |

5,000 | 800 | 293 hours | $18,448 |

10,000 | 1,600 | 587 hours | $36,896 |

15,000 | 2,400 | 880 hours | $55,344 |

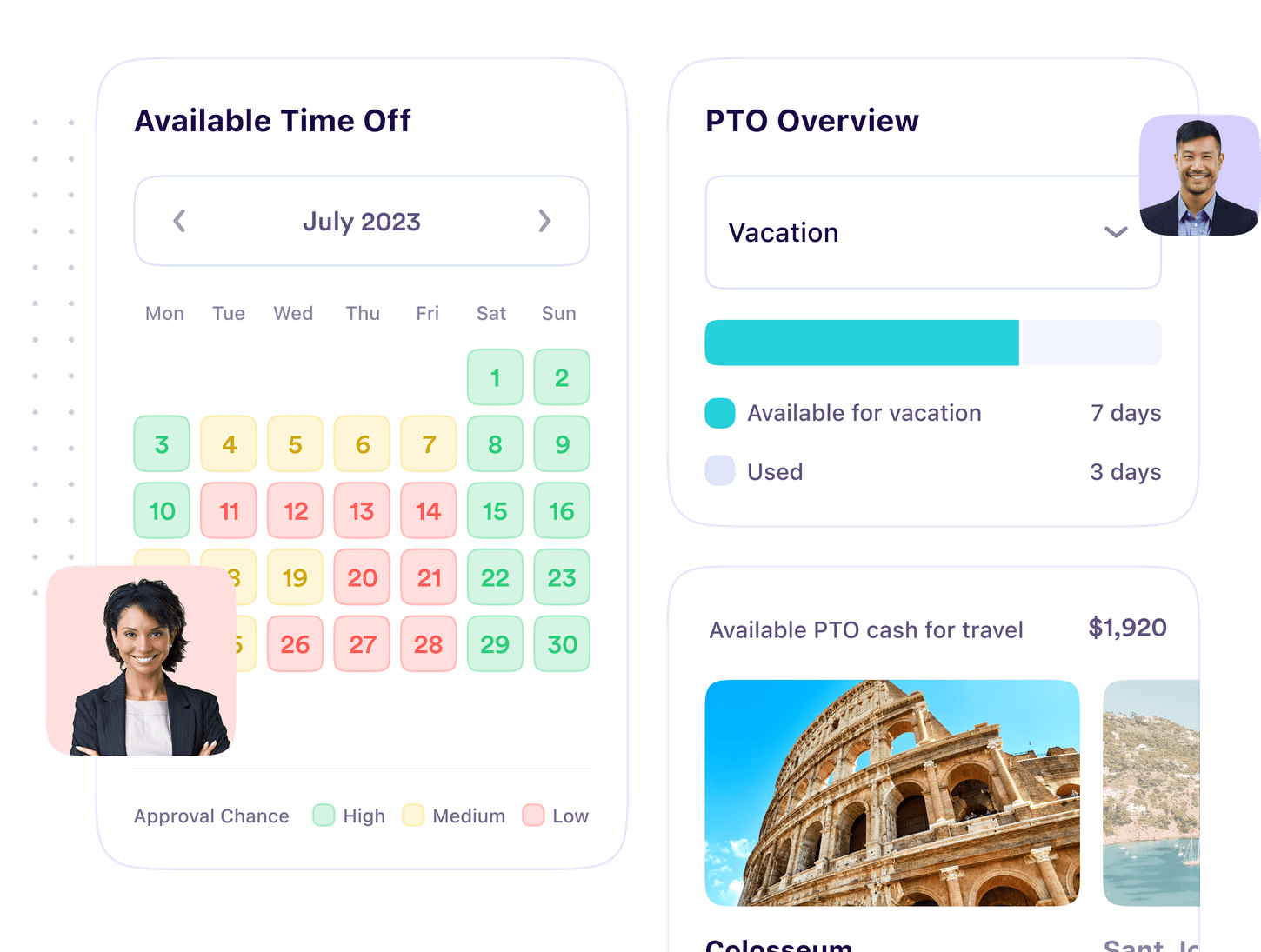

Automatic, Instant PTO and Vacation Accruals

Save time and money, improve time off tracking, and stay complaint with next-gen time off management.

SOX Compliance and PTO Accruals

Sarbanes-Oxley is a federal law that requires corporations to report accurate, timely financial information. Non-compliance with SOX can lead to criminal penalties for the CEO and CFO, who are held personally accountable for the contents of their company’s financial reports.

Because accrued paid time off is a financial liability, it must be reported. According to Oxford Economics, U.S. corporations carry $224 billion in PTO liabilities. An average employee has over $2,600 in unused PTO that may have to be paid out at employment separation, while executives can represent tens of thousands of dollars of liability.

The time-consuming, error-prone nature of manual PTO calculations makes it virtually impossible to ensure that PTO liability data is accurate. At an average error rate of 16%, a company with 5,000 employees is likely making 800 errors when they calculate and update their employee’s PTO balances every accrual period. Each error changes your knowledge of your PTO liabilities, materially impacting your company’s financial statements––making the CEO and CFO personally liable for misleading investors.

The root of the problem is that you don’t know what you don’t know about your PTO liability data––but this is where software can help. Solutions like PTO Genius automatically calculate and surface your PTO liability, accurately and reliably. We help ensure that your PTO liability data is accurate, and show you where this liability comes from.

Software to Automate PTO and Vacation Accruals

You have four software options for automating PTO and vacation accruals: your Human Resources Information System (HRIS), Google or Excel spreadsheets, standalone vacation trackers, and time off management platforms like PTO Genius.

Software | Pros | Cons | Best For |

Spreadsheets | Free | Don’t scale, highly error-prone Very time- No PTO liability calculation | Very small teams with one simple PTO policy |

HRIS | Included with your HRIS subscription Basic functionality gets the job done, mostly Employees already know where to go to report their time off | Bad UX leads to under-reporting of time off Doesn’t calculate or surface PTO liabilities Forces you to spend time fixing PTO accrual and liability errors | When your PTO program is too mature for spreadsheets, but not mature enough for a solution that’s dedicated to solving your time off problems |

Standalone Vacation Tracker | Gets the job done better than HRIS basic tools More automated than spreadsheets Easier to use than HRIS leave trackers | Doesn't calculate and surface PTO liabilities Doesn't adapt to your unique PTO policies Tracks time off but doesn't encourage it Adds another platform for employees and managers to log in to | Companies with basic time off policies that don’t care about surfacing PTO liabilities or encouraging time off |

PTO Genius | Complete platform that promotes, tracks, and converts employee time off in one place | Adds a platform for employees and managers to log in to | Employee-focused HR teams that want to save time, reduce costs, and simplify compliance while encouraging employees to use more of their time off |

Using HRIS for PTO Accruals

- Pros:

- Comes with your HRIS subscription

- Easy to get started quickly

- Cons:

- Bad user interface leads to under-reporting of time off

- Doesn’t include any PTO management functionality

- Force you to spend time fixing accruals and liability errors

- Best for:

- When your PTO program is too mature for spreadsheets, but not mature enough for a solution that’s dedicated to solving your time off problems

Your HRIS probably includes a basic PTO tracker: Bamboo, Paycor, ADP, Paylocity, Rippling, and others have basic functionality. This can potentially lead to good employee adoption because it’s part of a tool they’re already familiar with and using regularly.

However, time off management is not a focus for HRIS companies. As a result, they don’t include anything related to PTO liability––forcing you to spend tens, hundreds or even thousands of hours on liability calculations every accrual cycle.

Using Spreadsheets for PTO Accruals

- Pros:

- Free

- Easy to get started quickly

- Cons:

- Don't sclae, highly error-prone

- Time-consuming to manage

- No PTO ability calculation

- Best for:

- Very small teams with one, simple PTO policy

Google “PTO tracking spreadsheet” and you’ll get pages and pages of free templates for Microsoft Excel or Google Sheets. They usually include some very basic customization, but are inherently limited––after all, it’s just a spreadsheet. Using a spreadsheet to track employee time off can be a good starting point, but it doesn’t scale; you’ll end up spending hours every week updating spreadsheets and chasing down employees who didn’t report their time off. And when it comes to PTO liabilities, the free templates you find via Google search don’t account for this at all.

Using a Standalone Vacation Tracker for PTO Accruals

- Pros:

- Get the job done, for the most part

- More automated than spreadsheets

- Easier to use than HRIS leave trackers

- Cons:

- Don't calculate and surface PTO liabilities

- Don’t adapt to your unique PTO policies

- Track time off but don’t encourage it

- Best for:

- Companies with basic PTO policies that don’t care about surfacing PTO liabilities or actively encouraging time off

Many companies sell a basic vacation tracker for a small per-employee-per-month fee. These tools get the job done and typically have a better user experience than your HRIS. However, they’re only a step above spreadsheets in terms of automation and usefulness. They automate PTO accruals, but don’t calculate and surface PTO liabilities; they allow you to add multiple leave types, but don’t adapt to your unique policies; they; they track time off but don’t actively encourage it; and they don’t connect the dots between time off and burnout.

Using PTO Genius for PTO Accruals

- Pros:

- Solves all your PTO-related problems

- Adapts to all of your policies, no matter how complex

- Automatically calculates and surfaces PTO liabilities

- Cons:

- Adds a platform for employess to log in to

- Best for:

- Employee-focused HR teams that want to save time, reduce costs, and simplify compliance while encouraging employees to take more time off

PTO Genius is a new type of time off management platform that solves your most urgent and impactful time off problems. We improve the reliability and accuracy of PTO accruals and liability data, helping you stay compliant while identifying opportunities to reduce PTO liabilities.

Our platform’s modern, intuitive interface is easy for employees and managers to understand––leading to better reporting of employee time off, since employees and managers don't get lost in frustrating, outdated interfaces. Employee-centered companies use PTO Genius to build happier, healthier, and more engaged workplaces by helping everyone do more with their time off.

Hidden Costs: Delays in PTO Accrual vs. Granting

It costs 22-47 minutes and $23.37 to $46.43 to calculate and update the PTO balances for a single employee. But that’s not all. Most HRIS and time off management tools force a delay between accrual and granting of PTO––creating headaches, compliance concerns, and real pain. An employee might earn vacation time on an hourly basis, but only be “granted” that time off when payroll runs a week or two later. In the meantime, the company HRIS won’t have an accurate, up-to-date record of their accrued PTO.

This delay creates many problems. First, it means that your PTO records (including related liabilities) are only accurate at a very specific point in time: exactly when your payroll runs and PTO balances get updated in your HRIS.

Second, it means that your employees can’t use the time off that they’ve earned, when they actually need to use it. For example, an employee who earns 1 hour of PTO per workday will have earned 5 hours of PTO at the end of each workweek. However, because payroll runs every two weeks, the employee is granted PTO in 10-hour increments. If they need to take a few hours off to take their child to the doctor, they’re stuck––they can’t use the time off they’ve earned, because your HRIS hasn’t updated.

PTO Genius solved this problem with our time off management platform. If you enable it, employees are granted their time off when they actually accrue it––fixing an important disparity that causes hardship for employees and headaches for HR teams.

Automatic, Instant PTO and Vacation Accruals

Save time and money, improve time off tracking, and stay complaint with next-gen time off management.