PTO

PTO Accrual: How It Works With Different PTO Policies

Key Takeaways

- PTO accrual is the process by which employees earn paid time off (PTO)

- Traditional PTO accrual: vacation, sick leave, etc. is earned based on the time an employee works, up to a certain amount of hours or days per year

- Lump-sum PTO accrual: employees are given the full amount of their paid time off all at once; this may be “on credit” and accrued throughout the year

- Unlimited PTO: paid time off doesn’t actually accrue; employees can take as much time off as they need, whenever they need it

- Flex time off (FTO): FTO or discretionary time off policies may follow a regular accrual model or a lump-sum model

PTO (paid time off) accrual is a complex and costly process. So it’s important to understand how PTO accrual works with your specific type of policy.

Regular (periodic) accrual is the most common type of accrual, followed by lump-sum (also known as front-loading PTO). Unlimited vacation gets a lot of press (both positive and negative) and mostly skips the accrual process, while flex time and discretionary time off remain misunderstood and not standardized.

PTO Accrual: What It Is and How It Works

PTO accrual is the process by which employees earn paid time off (PTO). Traditionally, PTO is earned with time worked. Lump-sum PTO is granted all at once, while PTO doesn't accrue at all under an unlimited PTO policy. Flex time off (FTO) and discretionary time off (DTO) can use traditional or lump-sum accrual.

- Traditional PTO accrual: paid time off (vacation, sick leave, etc.) is earned based on the time an employee works, up to a certain amount of hours or days per year

- Lump-sum PTO accrual: employees are given the full amount of their paid time off all at once; this may be “on credit” and accrued throughout the year

- Unlimited PTO: paid time off doesn’t actually accrue––instead, employees can take as much time off as they need, whenever they need it

- Flex time off (FTO): FTO or discretionary time off policies may follow a regular accrual model or a lump-sum model

How you handle PTO accrual depends on what kind of PTO policies your company has. There are four common types PTO policy:

- Traditional PTO policies typically use a regular accrual frequency (hourly, daily, weekly, bi-weekly, semimonthly, or monthly), but sometimes use lump-sum

- Bank PTO policies often grant lump-sum PTO but sometimes accrue that time off over the course of the year

- Unlimited PTO policies don’t accrue, but you still need to account for state laws that may require paid sick leave to effectively accrue “on the back end”

- Flex Time Off (FTO) and Discretionary Time Off (DTO) policies are equally likely to use regular or lump-sum accrual

PTO Policy Type | PTO Accrual Frequency | Pros | Cons |

|---|---|---|---|

Traditional | Lump-sum or regular accrual | Employees who feel they’ve earned their PTO are more likely to use it; sets clear expectations with employees; can be customized to your specific requirements | Have to track PTO accrual and usage carefully; takes a lot of time to administer and manage; employees and managers get confused by how accruals work |

Bank | Lump-sum or regular accrual | Easy to understand; gives employees more flexibility and ownership of their PTO; relatively simple to manage | Incentivizes people to work while sick; still have to track accruals “on the back-end” even when front-loading; virtually impossible to keep in compliance |

Unlimited | Not applicable | Popular with employees; requires less time to administer; eliminates financial liabilities; gives people flexibility and ownership | Confusing expectations for employees; can be taken advantage of; hard to keep track of; difficult to keep in compliance; can lead to inequality and discrimination |

Flex or Discretionary | Lump-sum or regular accrual | Allows employees to take time off whenever they need for whatever purpose; easy for employees to understand | Confusing expectations for employees; difficult or impossible to keep in compliance if policies lump together vacation and sick time; incentivizes working while sick |

Regular PTO Accrual

Under a traditional PTO policy, employees earn paid time off in periodic increments based on the time they work. Regular PTO accrual allows employers to set clear expectations around the earning and usage of time off. Employees who feel like they’ve “earned” their time off are more likely to actually use it.

Many companies maintain different PTO policies for different employee types, locations, or departments. For example, one company might have three vacation policies for US-based employees:

- Hourly employees accrue 0.0533 vacation hours per hour of work (regular accrual) and can only use vacation time that they’ve earned

- Salary employees accrue 3.33 hours of vacation with each semimonthly paycheck, but are granted access to their full 80 hours “on credit” at the beginning of the year

- Executive employees have unlimited vacation time to avoid having to payout unused vacation at separation

Factors to take into consideration when crafting your regular PTO accrual policy include accrual period and rate; how you will verify the hours that employees work; whether employees can go into a negative PTO balance; whether you will maintain multiple policies for different employee types (or locations); and whether you will institute a waiting period before employees begin accruing PTO.

Accrual Period

The PTO accrual period is how often employees are granted the paid time off that they’ve earned during a given period of time. Most often, companies tie their PTO accrual period to their payroll cycle (bi-weekly or semimonthly). Other PTO accrual periods may make sense for different types of employees, however.

- Hourly PTO accrual

- Employees earn an amount of paid time off for every hour they work

- Best for hourly employees who work a varying number of hours per week

- Daily PTO accrual

- Employees earn paid time off in increments for each day that they work

- Best for employees who worked a fix amount of hours per day and a varying number of days per week

- Weekly PTO accrual

- Employees earn paid time off in increments for every week they work

- Best for hourly, part-time, or contract employees who work in weekly increments

- Bi-weekly PTO accrual

- Employees earn paid time off every two weeks

- Best for hourly and salaried employees who are paid bi-weekly

- Semimonthly PTO accrual

- Employees earn paid time off twice per month

- Best for hourly and salaried employees who are paid semimonthly

- Monthly PTO accrual

- Employees earn paid time off once per month

- Best when your payroll is run monthly

Accrual Rate

Accrual rate is how much paid time off employees earn per accrual period. To calculate PTO accrual rate, start with the maximum amount of PTO an employee can earn per year: 10 vacation days (80 hours for a traditional 8-hour workday) used to be standard, but companies are increasingly offering 15 or even 20 days of paid vacation per year.

Then divide by the number of increments in which they earn PTO throughout the year (accrual period): the number of hours they work per year (hourly accrual), the number of weeks they work per year (accrual); 26 (bi-weekly accrual); 24 (semimonthly accrual); or 12 (monthly accrual).

The result is the number of PTO hours (or days) the employee earns per accrual period.

How to Calculate PTO Accrual Rate

- Calculate the employee’s maximum yearly PTO balance

- 10 days = 80 hours

- 15 days = 120 hours

- 20 days = 160 hours

- Divide by the number of increments in the accrual frequency

- Hourly accrual = Number of hours worked per year

- Weekly accrual = Number of weeks worked per year

- Bi-weekly accrual = 26 accrual periods

- Semimonthly accrual = 24 accrual periods

- Monthly accrual = 12 accrual periods

- The result is the PTO accrual rate

How to Calculate PTO Accruals

PTO accrual is time-consuming and error-prone. This guide explains everything you need to know.

Verifying Hours

If employees earn their PTO based on the hours they work, how do you verify that they worked a particular number of hours in a given period of time? Typically, HR uses timesheets or punch-cards for this. Unfortunately, it can be very time-consuming and error-prone when done manually. For salaried employees, companies usually assume that they work 2,080 hours per year (though hourly PTO accrual is rarely used for salary employees––instead, PTO accrual frequency is tied to the payroll cycle).

Negative PTO

Employees that start the year with zero PTO balance are often frustrated when they can’t take time off early in the year. This is especially true when you have a use-it-or-lose-it policy under which unused PTO expires after a particular date (e.g. year’s end). To give employees more flexibility, some companies allow them to take PTO “on credit” before they’ve actually earned it: effectively accruing a negative PTO balance. Usually, companies place a limit on how far “into the red” an employee can go. For example, you might allow employees to go up to -8 hours (one day) so that they can take time off to care for a sick family member in the first few months of the year.

Multiple Policies

How do you structure different policies for different teams, locations, and employee types? Hourly employees versus salary, marketing versus front-line workers, European versus American locations, etc.

For example, different types of employees might accrue PTO at different rates or at different periods, or have different maximum balances. Many companies use hourly accrual for hourly employees, semimonthly accrual for salaried employees (tied to payroll frequency), and unlimited PTO for highly-paid executives.

This approach sets clear expectations and is easy to understand, while limiting PTO liabilities for the company.

Waiting Periods

Some companies require employees to work a certain amount of time (e.g. 30/60/90 days) before they start accruing paid time off. This is to avoid the problems that could stem from new employees taking time off while they're in training and learning the ropes. It also protects a company from having to pay out vacation time for employees who leave the company shortly after joining.

Note, however, that some states prohibit waiting periods for paid sick leave that is earned under state paid sick leave laws. If you're in a state with mandatory paid sick leave, be sure to read up on how your state's law handles waiting periods.

Lump-sum PTO Accrual

Lump-sum PTO is granted all at once. Typically, employers with lump-sum policies give employees all of their PTO at the beginning of the year, so that they can start using it immediately. This can apply to vacation time, sick leave, or both––in the latter case, this is often called a bank PTO policy.

Sometimes, a company gives its employees access to their full annual PTO balance but that PTO still accrues over time. An employee that takes vacation at the beginning of the year, therefore, is effectively using that PTO “on credit” (before it officially accrues). Importantly, some states’ PTO payout laws come into play here: a company may be obligated to track accruals even if you follow a lump-sum PTO accrual model.

Unlimited PTO Accrual

Unlimited PTO technically “side-steps” accruals by telling employees they can take as much time off as they need, whenever they need. Unlimited PTO has a handful pros and even more cons, but its simplicity is a big draw. However, as with lump-sum PTO, you may be legally required to track PTO accruals even if you have an unlimited policy.

This is because of PTO laws in certain states. For example, New Mexico’s paid sick leave law says that, “Employers who front-load sick leave must still monitor employee hours worked." Also, unlimited PTO gets very complicated when it overlaps with other types of paid leave, like parental leave and FMLA.

FTO & DTO Accrual

Flex Time Off (FTO) and Discretionary Time Off (DTO) are catch-all terms that are widely used but poorly understood. Like with unlimited PTO, under an FTO or DTO policy employees can take time off whenever they need. But unlike unlimited, FTO and DTO can be accrual-based; the “flex” in “flex time” refers to when it can be used, not necessarily to how much you get. You could have an FTO policy that accrues semimonthly, or which follows the frontloading lump-sum model. Flex and discretionary time off (DTO) are similar ideas and often used interchangeably.

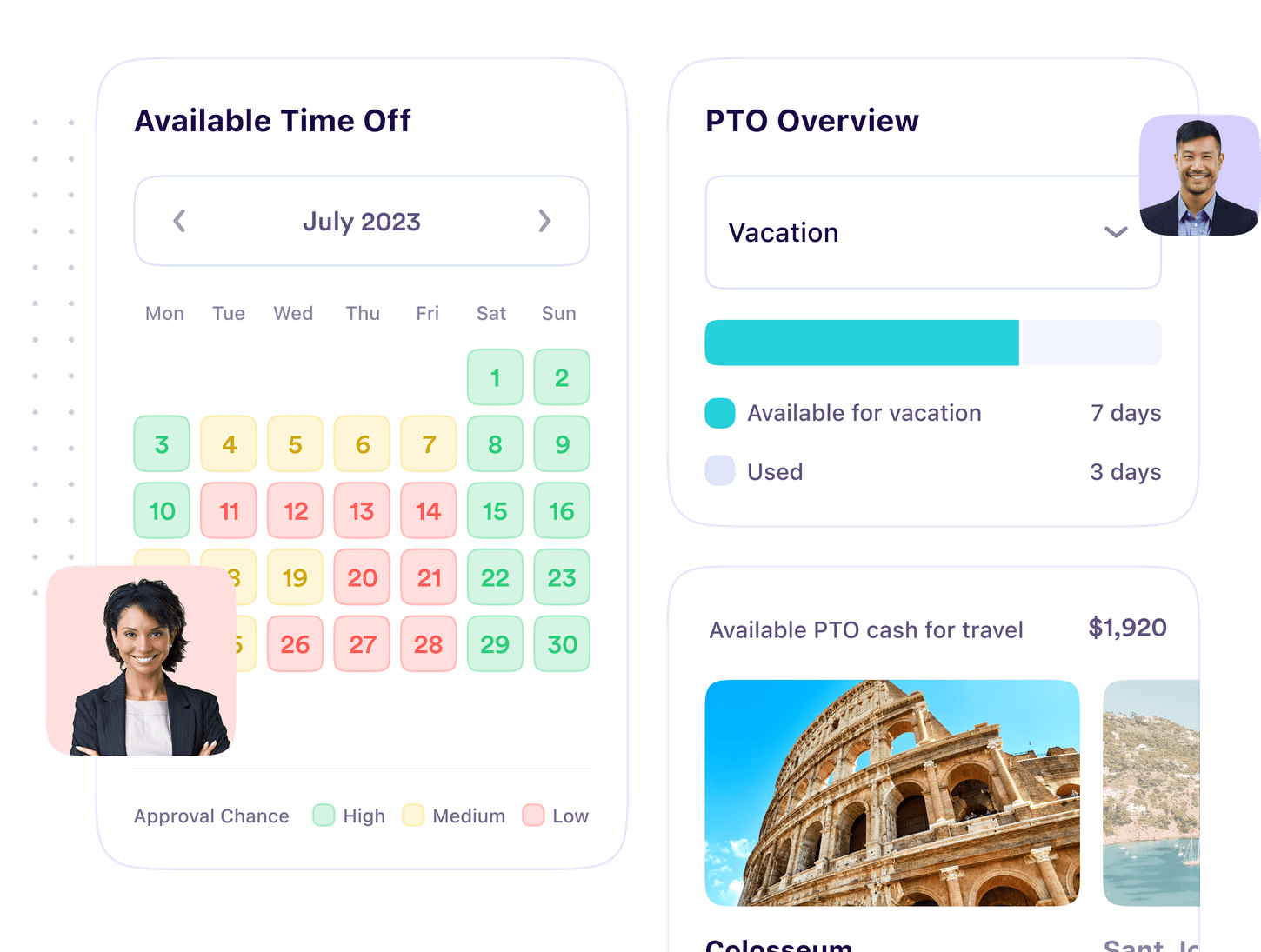

Automate PTO Accruals with PTO Genius

PTO accruals are a massive headache to manage. Even if you have unlimited PTO, you need to keep track of time off requests and approvals––and in California, the courts might ultimately say that your policy isn’t actually unlimited.

Ernst & Young studied the costs associated with common HR functions and tasks. They found that it takes 25 to 47 minutes and costs $19.19 to $38.13 to calculate PTO balances for one employee. Now multiply that by hundreds or thousands of employees.

Platforms like PTO Genius completely eliminate this cost and save you tens of hours of work with every accrual cycle. Automatic PTO accruals through our platform are reliable, trustworthy, and instant.

Automatic, Instant PTO and Vacation Accruals

Save time and money, improve time off tracking, and stay complaint with next-gen time off management.