Unlimited PTO

How Unlimited PTO Works In States With PTO Laws

Key Takeaways

- Many states have laws that make unlimited paid time off (PTO) very complex to manage.

- Unlimited PTO in California is especially complicated

- Unlimited PTO is not a “get out of jail free card” when it comes to PTO liability and accruals.

- You need to account for state laws that regulate the accrual and payout of paid time off, and how they relate to unlimited PTO policies.

- You also need to account for states that regulate vacation and sick time differently, because a single unified PTO policy may be out of compliance.

Introduction

Unlimited PTO is popular with employees, but can actually bring huge legal and compliance risks to your business. Many states have laws that regulate paid time off. If you’re in a state that mandates paid sick time, requires PTO payout at separation, or bans “use-it-or-lose-it” policies, you need to account for these laws in your policy.

Unlimited PTO in States With Mandatory Paid Sick Leave

There are no federal or state laws that require employers to give paid or unpaid vacation. However, a growing number of states have passed laws that mandate paid sick leave for employees.

U.S. States with Mandatory Paid Sick Leave

States with mandatory paid sick leave also require that employees accrue it with hours worked. Accrual rates are specified by law, unless an employer’s policy is more generous than the minimum.

Mandatory Sick Leave Accrual Rates In Each State

1 hour sick leave for every 30 hours worked | Arizona, California, Colorado, Maryland, Massachusetts, Minnesota, New Jersey, New Mexico, New York, Oregon |

1 hour sick leave for every 35 hours worked | Michigan, Rhode Island |

1 hour sick leave for every 40 hours worked | Connecticut, Illinois, Maine, Washington |

1 hour sick leave for every 52 hours worked | Nevada, Vermont |

Sick leave accrual rate varies based on employer size | Washington, D.C. |

The intersection of unlimited PTO and mandated paid sick leave is frightfully complicated.

Many unlimited PTO policies group vacation and sick time off under the same “PTO” banner. But while unlimited PTO does not accrue, paid sick leave is required to.

The upshot: for employers in states that mandate paid sick leave, unlimited PTO policies which lump vacation and sick days together may be automatically out of compliance because the law says that employees should accrue sick leave.

Unlimited PTO and Sick Time Accrual Laws

Some states allow employers to grant the total annual amount in a lump sum, rather than via accrual. At first, this sounds like it solves the “unlimited accrual problem”. But the reality is different.

Many states effectively require sick time to accrue "on the back-end" even under an unlimited policy.

For example:

- New Mexico: "Employers who front-load sick leave must still monitor employee hours worked."

- Oregon: "Your employer is required to let you know how much sick time you have accrued at least once every four months."

- Maryland: “Employers are required to provide employees with a written statement of the employee’s available earned sick and safe leave” (how often is not specified).

Furthermore, PTO records that do not distinguish between vacation and sick leave may create problems in cases where employee complaints are being investigated. New Mexico’s Department of Labor, for example, specifically recommends that you clearly mark paid sick leave as such in your records.

In states such as New Mexico and New York, unused up-front sick leave cannot be revoked, reduced, or recouped. Additionally, many states require employers to pay out unused sick leave when an employee leaves the company. Although unlimited PTO policies are generally exempted from this requirement, it's not always so clear-cut. Some states, including California and West Virginia, place particular emphasis on the wording of the employer's policy when determining whether payout is required. In cases where a policy is vague or ambiguous, the state department of labor may side with the employee.

Thoroughly research your state’s paid sick leave laws and account for them in your unlimited PTO policy. Make sure you know whether your state requires PTO payout at separation for sick leave, and pay special attention to whether how the law handles unlimited policies.

Unlimited PTO in States That Require PTO Payout

A number of states require employers to pay out the value of unused PTO at separation. In some states, all paid time off must be paid out; in other states, only vacation time has to be paid out, and sick leave does not. Additionally, some states do allow for employment contracts or PTO policies that don't pay out PTO at separation. Of these states, some give specific conditions that have to be met for such a policy to be valid, such as requiring employees to acknowledge the policy in writing.

Learn more about PTO payout laws here: Does Your State Have a Law That Requires PTO Payout?

U.S. States That Require PTO Payout at Separation

California (vacation only) | Colorado (all paid leave) |

District of Columbia (vacation, possibly sick leave) | Illinois (vacation only) |

Indiana (vacation only) | Louisiana (vacation, possibly sick leave) |

Maine (vacation only) | Maryland (vacation only) |

Massachusetts (vacation only) | Minnesota (vacation only) |

Montana (vacation only) | Nebraska (vacation only) |

New Mexico (vacation only) | New York (vacation only) |

North Carolina (vacation only) | North Dakota (vacation, possibly sick leave) |

Ohio (vacation, possibly sick leave) | Rhode Island (vacation only) |

West Virginia (depends on policy language) | Wyoming (vacation and sick leave) |

If you're in of these states, an unlimited PTO policy can mean cost-savings. If employees don’t accrue vacation days, there’s nothing to pay out when you separate.

Simple, in theory. But the reality is messier.

California considers earned vacation time to be a form of wages that has to be paid out at separation. This is standard stuff, but recent case law makes things tricky. According to employment law firm Fisher & Phillips, a California appellate court has ruled that it’s possible for vacation time to accrue “despite an employer’s efforts to establish an Unlimited PTO policy.”

Given that California is typically on the forefront of employee-friendly labor laws, it’s possible that the coming years will see more states cracking down on poorly-defined PTO policies.

In the meantime, don’t fall into the trap of believing that unlimited PTO is a “get out of jail free card” when it comes to liability and accruals. In fact, it’s likely worth consulting a qualified lawyer to ensure that your PTO policy is fully compliant, whether or not it’s unlimited and whether or not it’s a new policy.

Unlimited PTO in States that Ban “Use-It-or-Lose-It”

“Use-it-or-lose-it” is a tool that some companies use to limit their PTO liability. But several states prohibit policies that forfeit unused PTO at the end of the year. In addition, “use-it-or-lose-it” can be a source of resentment amongst employees who feel like they’re being cheated out of something they’ve earned.

A state's use-it-or-lose-it ban may apply to vacation time, paid sick leave, or both. States that have mandatory paid sick leave are often unclear on whether they prohibit use-it-or-lose-it for sick leave accrued under the law. Does Your State Have a Law That Bans Use-It-Or-Lose-It for PTO?

U.S. States that Ban “Use-It-or-Lose-It” for PTO

Arizona (sick leave) | California (both vacation and sick leave) |

Colorado (applies to any paid leave) | Connecticut (sick leave) |

District of Columbia (sick leave) | Maryland (sick leave) |

Massachusetts (sick leave) | Michigan (sick leave) |

Minnesota (sick leave) | Montana (vacation only, not sick leave) |

New Jersey (sick leave) | New Mexico (sick leave) |

New York City (sick leave) | Oregon (sick leave) |

Rhode Island (sick leave) | Washington (sick leave) |

For employers in these states, unlimited PTO can be a compliant way to eliminate PTO liabilities while giving employees freedom, flexibility, and ownership over their time off. However, California employers in particular should be very careful about assuming that simply calling their PTO policy “unlimited” means that employees don’t accrue time off.

Also, carefully read your state's laws to determine whether the "use-it-or-lose-it" ban applies to vacation time, sick leave, or both. Nebraska, for example, prohibits use-it-or-lose-it for vacation time but not for sick leave. Louisiana, on the other hand, bans it for vacation time but is less clear on whether it's allowed for sick leave.

If this is the primary draw of unlimited PTO for you, there are other ways to reduce PTO liabilities without risking non-compliance and angering employees. Encourage employees to use their time off, and look into setting up a PTO conversion program.

Unlimited PTO in California

Unlimited PTO is allowed in California. However, employers must be very careful. In the recent case of McPherson v. EF Intercultural, Inc., a California court found that vacation time can accrue and vest even if an employer has tried to establish an unlimited PTO policy. The court's reasoning was that in reality, evidence showed that EF Intercultural's employees were expected to take vacation within a limited range (e.g. 2-6 weeks)––making their unlimited policy not truly unlimited.

As the case of McPherson shows, unlimited vacation in California not as simple as saying "we have unlimited PTO" and calling it a day. In their ruling, the court includes four examples of ways companies can reduce the risk of their unlimited policy being found to be out of compliance. The court writes:

"Such a policy may not trigger section 227.3 where, for example, in writing it

Clearly provides that employees’ ability to take paid time off is not a form of additional wages for services performed, but perhaps part of the employer’s promise to provide a flexible work schedule—including employees’ ability to decide when and how much time to take off;

Spells out the rights and obligations of both employee and employer and the consequences of failing to schedule time off;

In practice allows sufficient opportunity for employees to take time off, or work fewer hours in lieu of taking time off; and

Is administered fairly so that it neither becomes a de facto "use it or lose it policy" nor results in inequities, such as where one employee works many hours, taking minimal time off, and another works fewer hours and takes more time off."

Unlimited PTO is very much doable in California––it just requires a careful approach.

Remember that California Labor Code Section 227.3 states that earned vacation time is a form of wages that is earned as labor is performed. Because of this, unused vacation must be paid out at separation from employment. Moreover, California prohibits use-it-or-lose-it policies, effectively requiring unused PTO to rollover from one year to the next (unless it's paid out at year's end).

Conclusion

Unlimited PTO is not as simple as it seems. If you’re considering a switch to unlimited, or if you already have it, you need to account for state laws that regulate the accrual and payout of paid time off.

You also need to account for states that regulate vacation and sick time differently, because a single unified PTO policy may be out of compliance.

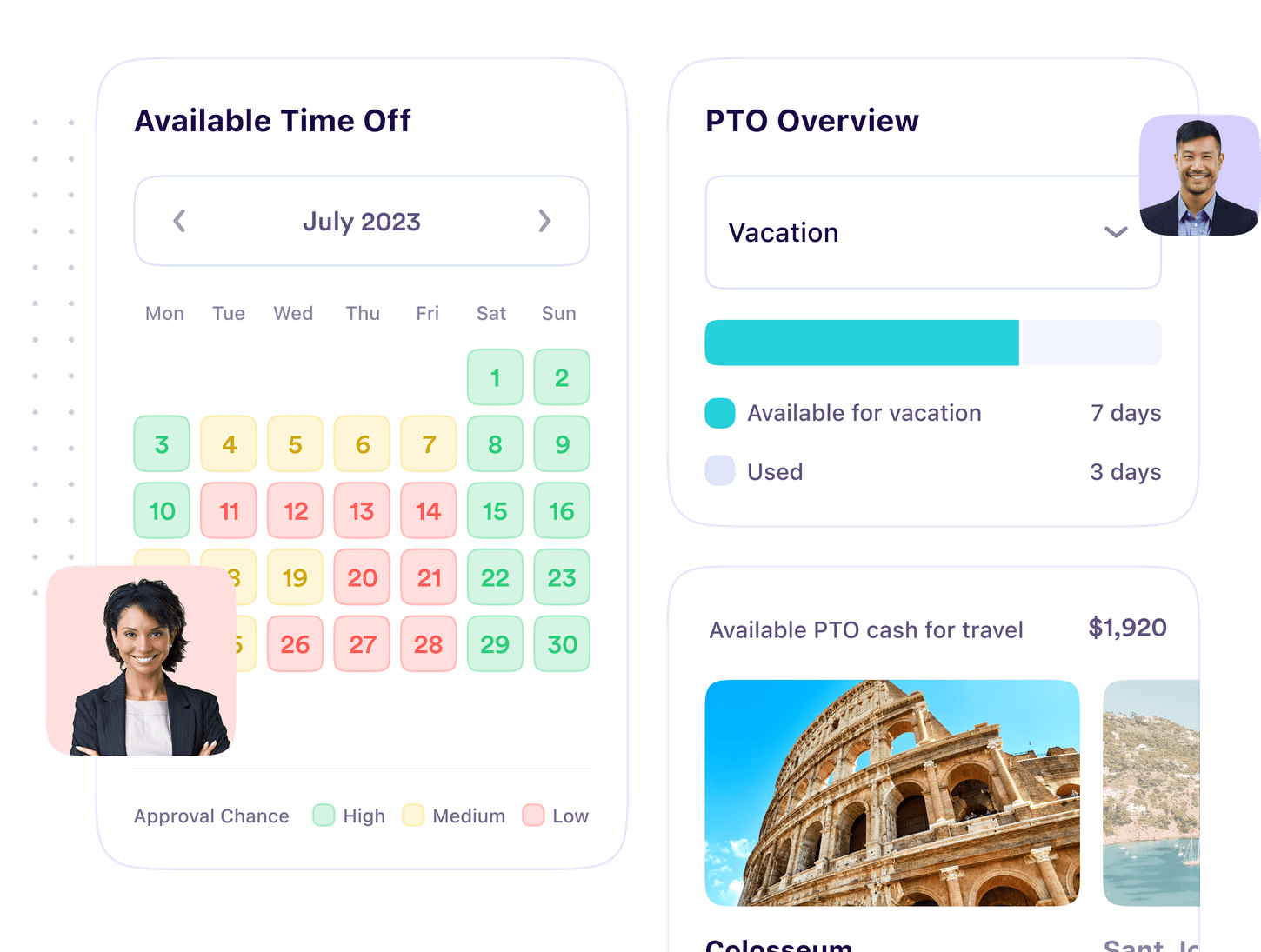

Finally, if you’re in a state that requires PTO payout, don’t assume that unlimited PTO is a “get out of jail free” card. And think about how you'll keep track of employee time off requests, approvals, and absences, for your own reporting purposes as well as for compliance.

Unlimited PTO

An effective unlimited PTO policy starts with the basics: here's everything you need to account for.