Employee Wellbeing

PTO Cash Out & Payout Policies: Things to Keep in Mind

Key Takeaways

- Keep these 4 things in mind when adding PTO cash out or payout to your PTO policy: goal, frequency, limits, and communication

- Start by defining your end-goal for PTO cash out

- Your goal should influence the frequency and limits you set

- Year-round PTO conversion is the most flexible and employee-focused approach

Introduction

PTO cash out is an increasingly popular benefit enhancement wherein employers pay employees the value of the paid time off (PTO) that they’ve accrued but haven’t used.

Given a choice between more money and more vacation days, different people make different choices; PTO cash out helps employers meet the needs of both groups.

PTO cash-out (also known as PTO payout or PTO buy-back) can happen in three scenarios: at employment separation; at year’s end; or year-round.

There are 4 key things to keep in mind when adding PTO cash out to your PTO policy:

- Your goal

- Cash out frequency

- Set limits

- Communication

And of course, always make sure you understand your state’s PTO payout laws and the nuts and bolts of PTO payout to ensure your program is fully compliant.

Define Your Goal

When writing a cash out option into your PTO policy, start with your goal: why are you doing this?

Your purpose will influence other elements of your program, including cash out frequency, and the rules or limits you set.

Some examples of reasons to set up a PTO cash out policy are.

- Helping employees improve their financial wellness

- Increasing access to travel and vacations

- Reducing your organization’s financial liabilities

- Increasing job satisfaction

Decide on Frequency

How often will you allow employees to cash out their PTO? Base this decision on your goal or purpose for the program.

For example, simple end-of-year PTO cash out can boost job satisfaction, but financial emergencies don’t only happen on December 31. To solve for financial wellness, you need to give people the flexibility to convert their PTO into what they need, whenever they need it.

Frequency | Pros | Cons | Other Notes |

|---|---|---|---|

At Separation |

|

| May be legally required, if your state requires PTO payout at separation |

End of Year |

|

| May be legally required, if your state prohibits “use-it-or-lose-it” policies for vacation or sick time |

Year-Round |

|

| Read up on PTO Conversion programs |

Set Reasonable Rules and Limits

What if an employee cashes out all of their PTO and doesn't actually take any time off? What if they cash out too many hours? How do we make sure they also take time off?

These are common concerns when it comes to PTO cash out. Luckily, they’re all easily solved.

The simplest way to avoid these issues is to make sure they never come up in the first place by establishing reasonable rules and limits around your cash out policy.

Here are some examples of limits you can set:

- How much PTO your employees can cash out at one time

- A cap on the $ value or number of PTO hours cashed out in a given time frame (typically per year)

- Whether people have to take time off for vacation (and how much) before cashing out PTO

- A minimum balance of PTO hours before you enable cash out

- Custom limits and guidelines by group, such as salaried vs hourly employees, department, or location

As an HR leader, it’s probably a good idea to get input from your managers and department heads. Then, write the rules and limit you decide on very clearly into your cash out policy.

Alternatively, solutions like PTO Genius bake this into our platform: we make it simple and easy to set and adjust very granular rules.

Communicate Clearly

The final thing to consider is how you will communicate your new PTO cash out policy to your employees and managers.

Exactly how you do it is up to you, of course. Leverage the channels you typically use to tell your employees about new and enhanced benefits: email blasts, an all-hands update, a dedicated training session, and so on. Face-to-face meetings with managers can be a great way to get them on board. Then ask them to update their own employees.

Your goal should be to make sure everyone understands everything they need to know, such as:

- How to cash out PTO

- How frequently they can cash out PTO

- How much PTO they can cash out at once

- How much time off they need to use for vacations before they’re allowed to cash out

You also may want to write something into your PTO policy itself. For inspiration, LawInsider.com has collected almost 50 examples of PTO cash out sample clauses, and SHRM Members can access and download an example PTO policy with provisions for cash out and payment on termination.

PTO Cash Out vs. PTO Conversion

PTO cash out policies can help a lot of people. But employees want benefits that adapt to their lifestyle, background, interests, and needs.

PTO conversion is an exciting new evolution of PTO cash out that is more flexible and personalized. Through PTO conversion, employees can use more of their PTO for more things, based on their own needs and priorities.

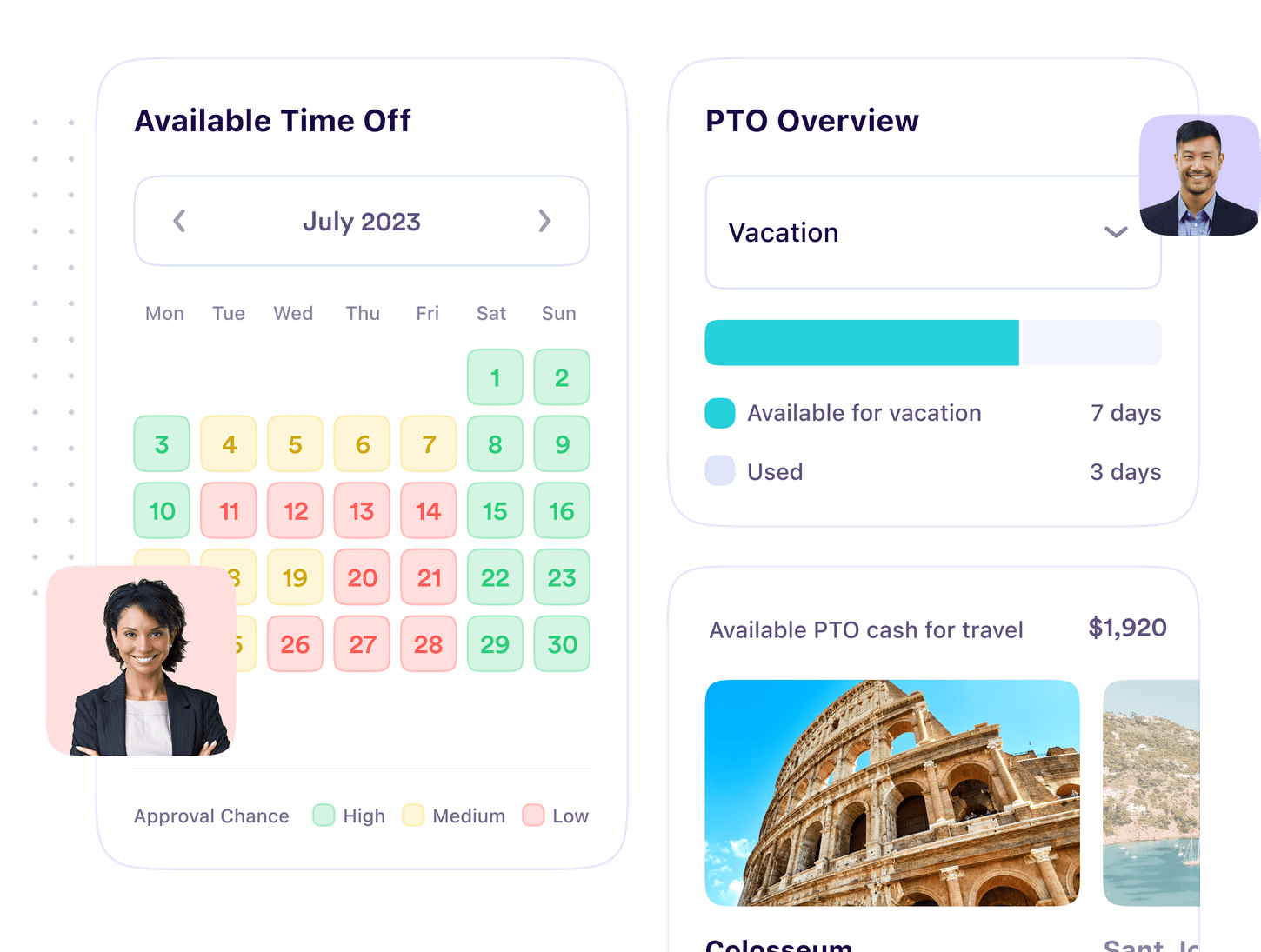

In this example, a recent graduate finds their balance between taking time off and using the value of their PTO for travel and financial wellness:

Compared to buy-back or cash out, the inherent flexibility of PTO conversion makes it a better solution for employees’ financial and mental well-being.

With PTO Genius, for example, you can allow employees to convert PTO into:

- Financial wellness (retirement contributions, student loan payments, and cash)

- Health savings (ABLE, HSA, and LSA contributions)

- Travel (flights, hotels, activities and experiences)

- And more (charitable donations, PTO donations to other employees)

By letting employers pick and choose the channels through which their employees can convert PTO, we enable HR leaders to align their policies and goals with their employees’ financial wellness needs.

PTO Cash Out & Payout Resources

Curious to learn more about PTO payout, vacation cash-out, or PTO conversion? We've collected a number of resources with more info and ideas.

- PTO Payout: What, When, and How It Works

- PTO Conversion Overview

- PTO Genius for Employers

- PTO Genius for Employees

Discover the More Flexible Alternative to PTO Payout

PTO conversion enables employees to convert their unused paid time off into mental and financial wellness, based on their own needs and priorities.