PTO

PTO Payout: What, When, and How It Works

Key Takeaways

- PTO payout (PTO cash out) is when you pay out the value of an employee’s unused vacation days, sick time, or other paid time off (PTO)

- Payout of PTO usually occurs at year’s-end, at retirement, or at employment separation, unless you have PTO conversion

- Whether employees have the right to get paid for their unused PTO depends on the state you’re in, and your policies

- Calculate PTO payout based on the employee’s hourly pay rate and unused PTO hours (or with their converted hourly rate, for salaried employees)

- The IRS taxes PTO payout as supplemental wages at 22%

What is PTO Payout?

PTO payout is when an employer cashes out the value of an employee’s accrued-but-unused paid time off (PTO). This usually happens when an employee leaves their company, though sometimes companies cash out unused PTO at year’s end, or under other circumstances.

PTO payout is essentially the same thing as PTO cash out––the terms are basically synonymous. Or, some companies say that PTO payout happens when an employee leaves the company; at other times, it's PTO cash out or PTO conversion.

PTO payout can apply to vacation time, sick time, and other forms of paid time off.

As an employer, it’s important to understand the value of PTO and how PTO payout works. You should also know which states require employers to pay unused vacation or sick time; how PTO payout is taxed; and how different circumstances affect PTO payout, such as when an employee quits versus when their employment is terminated.

When to Cash Out PTO

When a person can cash out their PTO depends on the laws of the state you’re in, and your company’s policies. Some states require employers to pay out unused PTO when a person leaves the company. Other states prohibit "use-it-or-lose-it" policies for vacation, sick leave, or both. Most states, however, leave it up to each company’s PTO policies or employment agreements.

When to pay out PTO:

- Quitting

- Termination

- Retirement

- Year's end

- Year-round (PTO conversion)

Most of the time, employees can only cash out unused vacation time and other PTO in the form of a payout when they leave their company, whether retiring, quitting, or being fired.

Some companies, however, allow their employees to cash out unused PTO at year’s end. And employers who offer PTO conversion programs give their employees the option to convert accrued-but-unused PTO into cash, retirement savings, student loan payments, and more, whenever you need or want it.

For employees, year-round PTO conversion gives flexibility and ownership over when and how you use your paid time off benefit. For companies, PTO conversion is a proven way to limit PTO-related financial liabilities while complying with “use-it-or-lose-it” bans.

Taxation of PTO Payout

In most states, earned PTO (vacation, sick time, or both) is considered to be a form of wages. The IRS taxes payout of accrued vacation and other PTO at the supplemental income tax rate of 22%.

As an employer, make sure you set up your payroll system to handle tax deductions for employee vacation cash out and PTO conversions. Your employees will expect you to handle all of the relevant deductions, just as you do with regular paychecks and bonuses.

How to Calculate PTO Payout

To calculate PTO payout, take the employee’s hourly pay rate and multiply it by the number of unused PTO hours they are cashing out or converting into something else. Then subtract 22% for taxes to see how much money they should expect to receive or convert.

Hourly Employees: Calculate PTO Payout

To calculate PTO payout for an hourly employee, the process is simple:

(Hourly pay rate in $) x (# of unused PTO hours) = pre-tax PTO payout

Multiply the pre-tax payout by .78 to account for the 22% tax rate

The result is the final PTO payout

For example, with an hourly employee making $15 per hour with 30 hours of unused PTO:

($15 per hour) x (30 unused PTO hours) = $450 PTO payout (pre-tax)

$450 x .78 = $351 final PTO payout

Salary Employees: Calculate PTO Payout

Calculating PTO payout for a salaried employee starts by figuring out their equivalent hourly pay rate:

Convert your salary into an hourly rate

(Equivalent hourly rate) x (#of unused PTO hours) = pre-tax PTO payout

Multiply the pre-tax payout by .78 to account for the 22% tax rate

The result is the final PTO payout.

The formula to find an employee’s equivalent hourly rate is:

(Salary in $) ÷ (2,080 working hours per year) = Hourly pay rate

Note: Most companies use 2,080 as the standard number of hours a salaried person works per year (roughly 52 weeks in a year x 40 working hours per week). Some companies use 2,087 hours, however, so make sure you use the same number as your payroll.

For example, given an employee with a salary of $60,000 and 30 hours of unused PTO:

($60,000) ÷ (2,080) = $28.85 per hour

($28.85 per hour) x (30 unused PTO hours) = $865.38 PTO payout (pre-tax)

$865.38 x .78 = $675 final PTO payout

How to Cash Out PTO

To cash out PTO, send a request to your Human Resources department. Use the simple email template below; be sure to include any other information or follow any other instructions outlined in your company’s PTO cash out policy. Alternatively, you can use PTO Genius to cash out PTO in just a few steps. Our platform is easy to use, protected by SSL encryption, and backed by SOC 2 and ISO 27001 security controls.

PTO Cash Out Email Template

Dear [HR Person’s Name],

Following our company policy, I wish to cash out some of my unused paid time off. Please find the relevant information below:

- Type of PTO to cash out: [Vacation / Sick / Other (specify)]

- Hours of PTO to cash out: [Number of hours]

- Destination: [My direct deposit account / Physical check / Other (specify)

Please let me know if there is any additional information I need to provide.

Sincerely,

[Your Name]

How to Cash Out PTO With PTO Genius

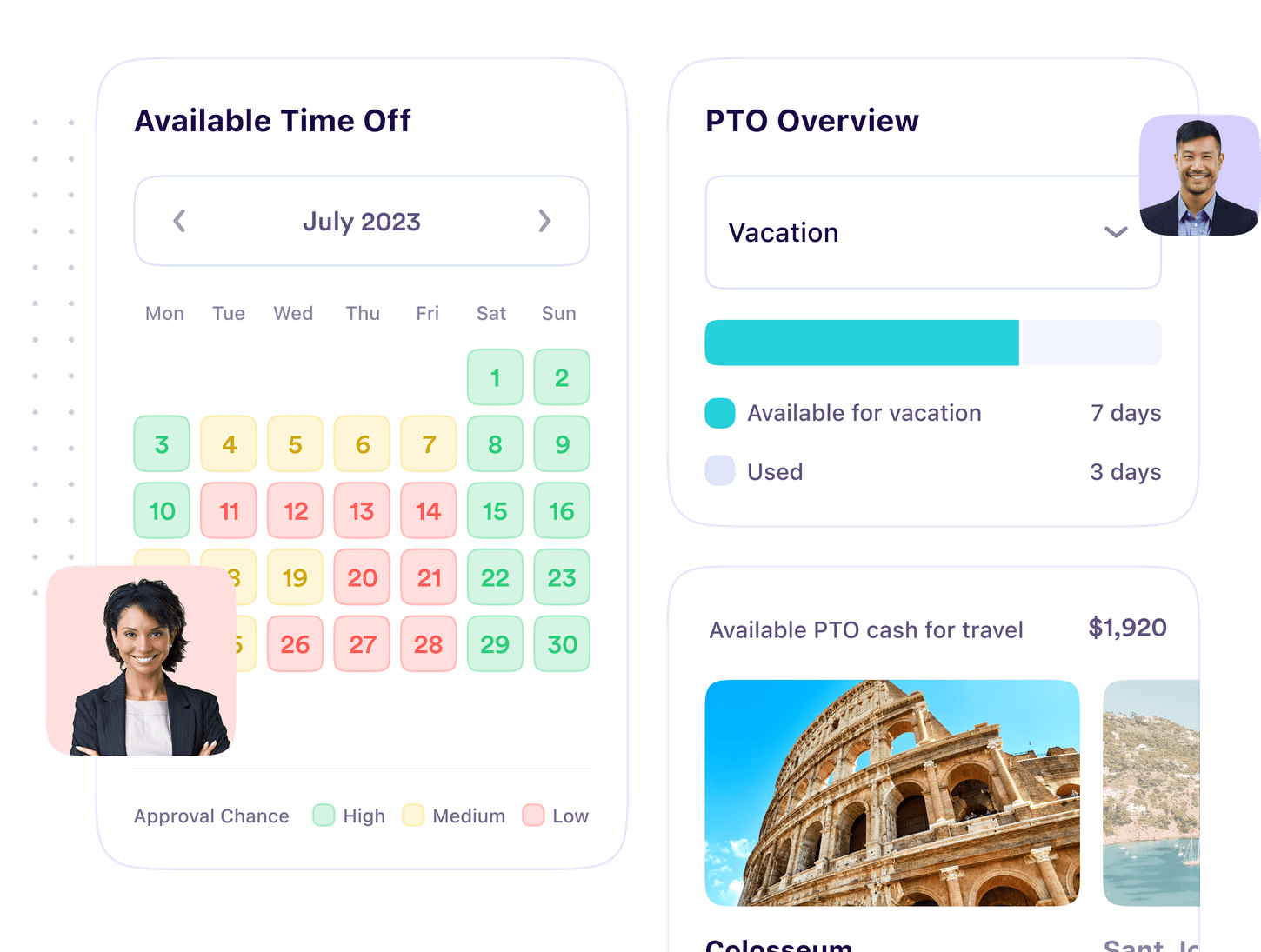

1. From your PTO Genius dashboard, choose what you want to convert your PTO into: cash, retirement savings, student loan payments, and more.

2. Specify how many hours of PTO you want to convert, or simply select “As many as possible”.

3. Specify the account into which you want your PTO cash out to be deposited.

4. Enter the email through which we’ll confirm your PTO cash out.

5. Confirm the amount you’re cashing out, the destination, and how much you’ll receive.

6. Confirm the acknowledgements, then click “Request PTO conversion”.

Do Companies Have to Pay Out PTO?

20 U.S. states legally require employers to pay employees the value of their unused PTO at the end of employment. Other states don’t have specific laws that mandate payout of unused vacation days or sick time. In these cases, employers have to follow their PTO policies and employment agreements.

Note: When a company’s PTO policy and employment agreement don’t include mention of payout of unused accrued vacation or sick time, the company may be obligated to pay out.

Employers in states that require PTO payout at separation must keep careful track of their employees' PTO accruals. Even companies with unlimited PTO may need to track accruals: a California appellate court has ruled that it’s possible for vacation time to accrue “despite an employer’s efforts to establish an Unlimited PTO policy". This is also true in states with mandatory paid sick leave.

U.S. States That Require PTO Payout at Separation

California (vacation only) | Colorado (all paid leave) |

District of Columbia (vacation, possibly sick leave) | Illinois (vacation only) |

Indiana (vacation only) | Louisiana (vacation, possibly sick leave) |

Maine (vacation only) | Maryland (vacation only) |

Massachusetts (vacation only) | Minnesota (vacation only) |

Montana (vacation only) | Nebraska (vacation only) |

New Mexico (vacation only) | New York (vacation only) |

North Carolina (vacation only) | North Dakota (vacation, possibly sick leave) |

Ohio (vacation, possibly sick leave) | Rhode Island (vacation only) |

West Virginia (depends on policy language) | Wyoming (vacation and sick leave) |

Read more about each state's PTO payout laws: PTO Laws by State - PTO Payout at Separation

U.S. States that Prohibit “Use-It-or-Lose-It” Policies

Arizona (sick leave) | California (both vacation and sick leave) |

Colorado (applies to any paid leave) | Connecticut (sick leave) |

District of Columbia (sick leave only) | Maryland (sick leave) |

Massachusetts (sick leave) | Michigan (sick leave) |

Minnesota (sick leave) | Montana (vacation only, not sick leave) |

New Jersey (sick leave) | New Mexico (sick leave) |

New York City (sick leave) | Oregon (sick leave) |

Rhode Island (sick leave) | Washington (sick leave) |

Some U.S. states prohibit policies under which employees automatically forfeit their unused vacation time or sick leave (or both) by a particular date, such as the end of the year. Three states prohibit use-it-or-lose-it for vacation time, while 15 states probably or certainly require it for sick leave as well. Common wisdom holds that Nebraska also bans use-it-or-lose-it, but this is not actually true: Nebraska only requires payout at separation of unused vacation time.

Employers in states that both mandate PTO payout at separation and prohibit use-it-or-lose-it could have a major financial liability on their books, unless they take steps to reduce their floating PTO balances.

Read more about each state's use-it-or-lose-it laws at PTO Laws by State - Use-It-Or-Lose-It

PTO Payout When Quitting

When a person quits their job, they may be entitled to PTO payout. This depends on the laws of the state they're in, and the policies of their company. 20 U.S. states require payout of unused PTO when an employee quits: California, Colorado, District of Columbia (Washington, D.C.), Illinois, Indiana, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Montana, Nebraska, New Mexico, New York, North Carolina, North Dakota, Ohio, Rhode Island, West Virginia, and Wyoming. In other states, it depends on the company's PTO policy or employment contract.

Vacation Payout at Termination

Most U.S. states do not require companies to payout unused vacation time when they terminate at employee. However, 20 states do require vacation payout at termination: California, Colorado, District of Columbia (Washington, D.C.), Illinois, Indiana, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Montana, Nebraska, New Mexico, New York, North Carolina, North Dakota, Ohio, Rhode Island, West Virginia, and Wyoming.

Read up on your state's PTO payout laws with our interactive map.

Consequences of Not Paying Out PTO

States that mandate PTO payout at separation also impose strict consequences if you fail to do so. That’s because in these states, earned PTO is considered a form of wages. Therefore, relevant laws governing the payout of final wages apply–including the penalties.

Penalties for not paying out PTO when required come in many forms. Examples include:

2x or 3x the amount of unpaid wages

The amount of unpaid wages, plus up to 30 days’ worth of wages

$500 per failure, plus 5% per day if the employer fails to pay within 7 days of the due date

Even when a state doesn’t require PTO payout at separation, the wording of a PTO policy or employment contract could be found to mean that earned PTO is a form of wages. In these situations, you could also be subject to harsh penalties.

In Arkansas, for example, your PTO policy or employee contract governs whether accrued but unused vacation is paid on separation. If either document does promise payout, and you fail to include this in their final paycheck, you will be liable for double the final wages due.

Be sure to thoroughly review your state’s laws governing accrual and payout of PTO. Keep in mind that some states treat vacation days and sick leave differently.

Year-Round PTO Payout with PTO Conversion

In 2023, more than half of employees say that wellbeing and related benefits are more important to them than a salary increase. But financial stress is still a major contributor to disengagement at low productivity at work. In this context, companies are looking for ways to simultaneously improve their employees’ financial wellness while still encouraging time off.

An increasingly popular solution is PTO conversion, an evolution of PTO buy-back or vacation cash-out. PTO conversion turns static, one-size-fits-all PTO policies into a personal, customized benefit that adapts to each employees’ individual needs and priorities.

PTO conversion programs give employees the option to convert and self-direct some of their accrued paid time off into cash, retirement savings, student loan payments, and more.

Compared to PTO buy-back or cash-out, PTO conversion accounts for a wider range of employee needs by offering more channels through which to convert PTO.

What To Do Next

Both employers and employees need to understand their rights and obligations concerning payout of unused paid time off. Employers should familiarize themselves with their state’s PTO laws. Employees should understand how PTO payout works and what they are owed in particular circumstances. All parties should be aware of the tax implications of PTO payout.

Also take a look at PTO conversion. This benefit goes above and beyond simple cash out programs to let employees use their PTO for more things, based on their own needs and priorities.

Discover PTO Conversion

This innovative benefit solves many of the challenges associated with PTO payout and cash out.