PTO (paid time off) accrual is complicated and costly. This guide explains how to calculate PTO accruals for hourly and salary employees, with easy-to-use formulas.

Read MoreRecent Articles

Expand your Time Off and General HR knowledge with detailed articles, tutorials and case studies.

Human Resources

PTO Accrual: The Costs of Calculating PTOAdjusted for inflation, it takes 25 to 47 minutes and costs $23.37 to $46.43 to calculate and update the PTO balances for a single employee. This article dives deeper into those costs and breaks them down by number of employees.

Read MorePTO

PTO Accrual: How It Works With Different PTO PoliciesTraditional vacation accrual, lump-sum PTO, unlimited PTO, and flex time all work differently. Here's everything you need to know about how PTO accrual works.

Read MoreFederal Laws

Sarbanes-Oxley (SOX) Compliance for HR DepartmentsHuman resources play a critical role in Sarbanes-Oxley (SOX) compliance. It's important to understand how it affects HR departments, and how HR can team up with finance to help with SOX compliance.

Read MorePTO

PTO (Paid Time Off) Explained: What It Is, How It Works, Types of PTO Policies & MoreCommon PTO policies, pros and cons of PTO policy types, how to choose a PTO policy, time off compliance info and much more about PTO.

Read MoreEmployee Wellbeing

PTO Cash Out & Payout Policies: Things to Keep in MindAdding PTO cash out or PTO payout to your PTO policy? Keep these 4 things in mind: goal, frequency, limits, and communication.

Read MorePTO

PTO Payout: What, When, and How It WorksEverything employers need to know about PTO payout and PTO cash out: when employees can cash out PTO; how to calculate payout; which states mandate it; how it’s taxed; and more.

Read MoreUnlimited PTO

How Unlimited PTO Works With Other Types of LeaveUnlimited paid time off gets very complicated when it overlaps with holidays, sick time, parental leave, FMLA, short-term disability, and other leave.

Read MoreUnlimited PTO

How Unlimited PTO Works In States With PTO LawsUnlimited PTO policies need to account for state laws that mandate paid sick time, require PTO payout at separation, or prohibit “use-it-or-lose-it” policies.

Read MoreUnlimited PTO

Unlimited Paid Time Off (PTO): How to Do It RightEverything you need to know about unlimited paid time off: what "unlimited" vacation really means, and how to implement a successful unlimited PTO policy.

Read MoreBurnout

5 Creative Ways to Reduce Employee BurnoutIn the post-Covid workplace, here are 5 things you and your HR team can do to reduce employee burnout by encouraging employees to disconnect and recharge.

Read MoreEmployee Wellbeing

The Rise of Personalized Total WellnessPersonalized Total Wellness programs holistically incorporate the eight dimensions of wellness based on the personalized needs of the individual employee.

Read MoreUnlimited PTO

Unlimited PTO Pros and Cons: Is It Good or Bad?Unlimited vacation sounds like a dream but can quickly turn into a nightmare. Here are the pros, cons, and risks of unlimited paid time off (PTO) policies.

Read MoreEmployee Engagement

Boost Employee Engagement by Optimizing Time OffOne of the fastest ways to boost morale and transform employee engagement is to encourage people to use their paid time off.

Read MorePTO

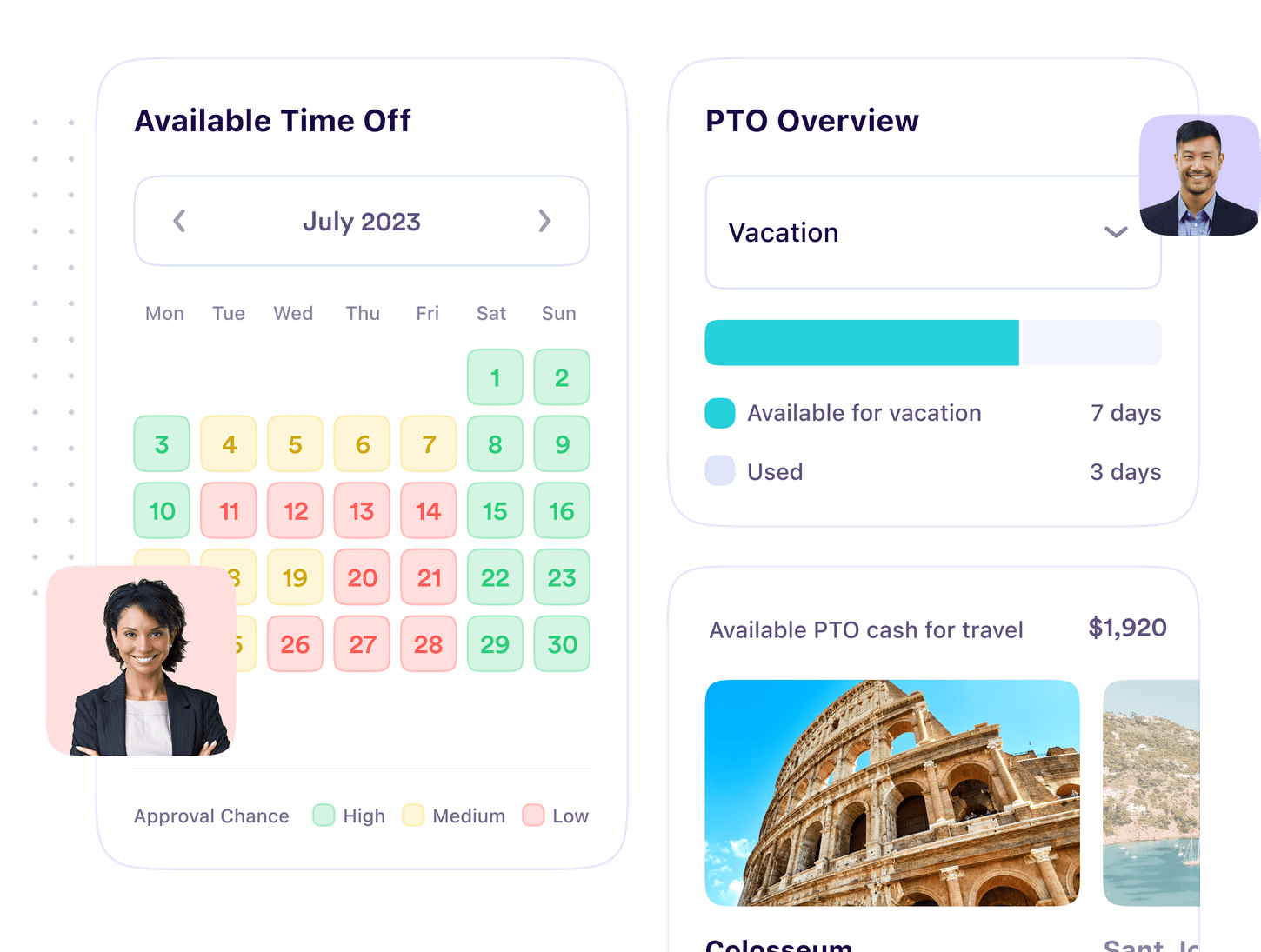

Rethinking Your Approach to Paid Time Off (PTO)Over half of Americans don't use all their paid time off. New solutions are solving this by improving access to PTO and transforming what PTO means.

Read More

Experience the Future of Time Off, Today

See how PTO Genius saves you time and money while preventing burnout and compliance issues. Try our next-generation time off tracking, automation, and compliance platform for free today.

Sign Up For Free